Trump Greenlights Alternative Assets in 401(k) Plans

- President Trump will sign an executive order allowing alternative assets—including crypto, private equity, and real estate—into 401(k) retirement plans, directing the Department of Labor to revise fiduciary rules under ERISA.

- This move marks a significant win for the alternative asset industry and comes amid rising institutional interest, with firms like BlackRock and Empower planning retirement products that include private investments.

- While the change may offer diversification benefits, it also raises concerns about risk, fees, and transparency, as these assets are typically less liquid and more complex than traditional retirement options.

In a significant move that could reshape retirement planning in the U.S., President Donald Trump is set to sign an executive order today allowing alternative assets like private equity, cryptocurrencies, and real estate to be included in 401(k) retirement plans. The directive, which will instruct the U.S. Department of Labor to reassess fiduciary guidance under the Employee Retirement Income Security Act (ERISA), aims to widen the investment options for defined contribution plans.

What the Executive Order Entails

The order will require the Labor Department to review existing rules surrounding alternative investments in retirement plans. While traditionally excluded due to concerns over liquidity, transparency, and risk, private market assets such as crypto and real estate could now become a viable part of Americans’ $8.7 trillion in defined contribution assets. The change builds upon 2020-era guidance from Trump’s first term and represents a victory for asset managers who have long pushed for broader exposure within 401(k)s.

Implications for the Market

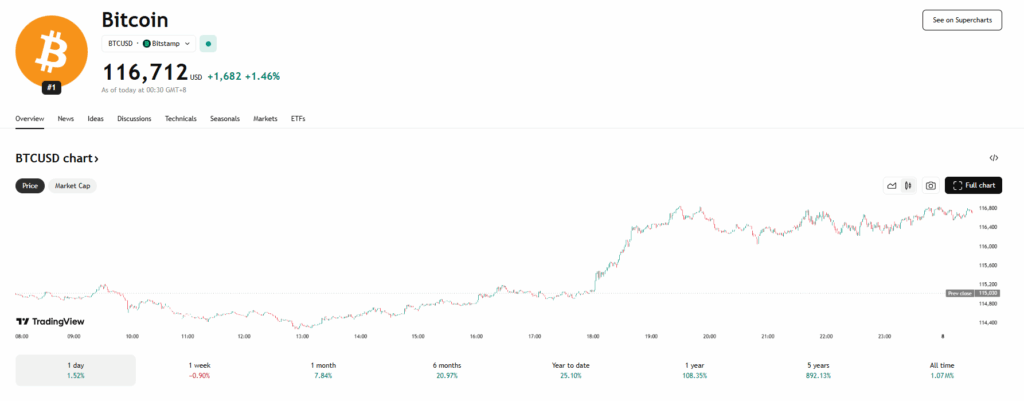

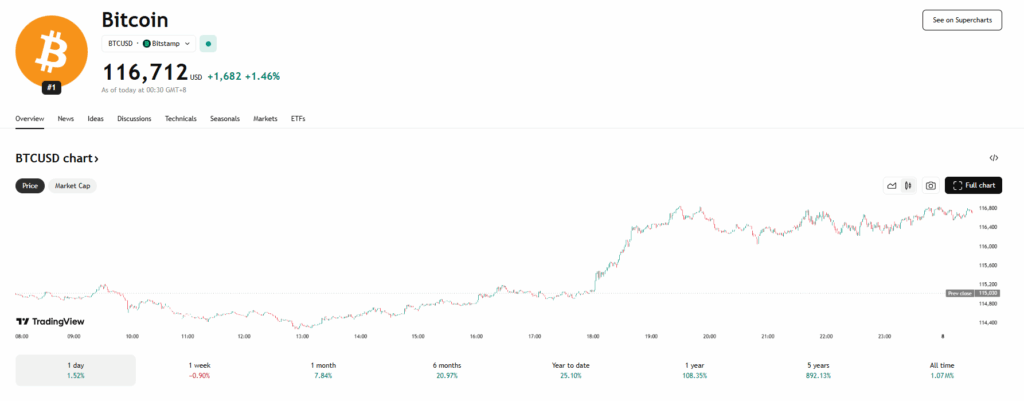

Markets have already reacted positively. Bitcoin saw a sharp uptick following the news, and stocks tied to private equity, like Apollo Group, also saw early trading gains. Notably, BlackRock plans to launch a target-date 401(k) fund in 2026 with up to 20% allocation in private assets. Empower, another major player, is also preparing to integrate alternative asset access into its retirement accounts this year.

Risks and Considerations

While the executive order opens the door for greater diversification, it also introduces new risks. Private investments come with higher fees, reduced liquidity, and longer holding periods. However, with the right structuring and fiduciary oversight, they could provide retirement portfolios with access to growth sectors historically reserved for institutions and ultra-wealthy investors.

Outlook

This executive order represents a bold step in modernizing retirement options, aligning them more closely with current market trends and institutional strategies. Still, implementation details, especially around fiduciary duties and investor protections, will be crucial in determining how widely these assets are adopted in 401(k) plans.

The post Trump Greenlights Alternative Assets in 401(k) Plans first appeared on BlockNews.

Trump Greenlights Alternative Assets in 401(k) Plans

- President Trump will sign an executive order allowing alternative assets—including crypto, private equity, and real estate—into 401(k) retirement plans, directing the Department of Labor to revise fiduciary rules under ERISA.

- This move marks a significant win for the alternative asset industry and comes amid rising institutional interest, with firms like BlackRock and Empower planning retirement products that include private investments.

- While the change may offer diversification benefits, it also raises concerns about risk, fees, and transparency, as these assets are typically less liquid and more complex than traditional retirement options.

In a significant move that could reshape retirement planning in the U.S., President Donald Trump is set to sign an executive order today allowing alternative assets like private equity, cryptocurrencies, and real estate to be included in 401(k) retirement plans. The directive, which will instruct the U.S. Department of Labor to reassess fiduciary guidance under the Employee Retirement Income Security Act (ERISA), aims to widen the investment options for defined contribution plans.

What the Executive Order Entails

The order will require the Labor Department to review existing rules surrounding alternative investments in retirement plans. While traditionally excluded due to concerns over liquidity, transparency, and risk, private market assets such as crypto and real estate could now become a viable part of Americans’ $8.7 trillion in defined contribution assets. The change builds upon 2020-era guidance from Trump’s first term and represents a victory for asset managers who have long pushed for broader exposure within 401(k)s.

Implications for the Market

Markets have already reacted positively. Bitcoin saw a sharp uptick following the news, and stocks tied to private equity, like Apollo Group, also saw early trading gains. Notably, BlackRock plans to launch a target-date 401(k) fund in 2026 with up to 20% allocation in private assets. Empower, another major player, is also preparing to integrate alternative asset access into its retirement accounts this year.

Risks and Considerations

While the executive order opens the door for greater diversification, it also introduces new risks. Private investments come with higher fees, reduced liquidity, and longer holding periods. However, with the right structuring and fiduciary oversight, they could provide retirement portfolios with access to growth sectors historically reserved for institutions and ultra-wealthy investors.

Outlook

This executive order represents a bold step in modernizing retirement options, aligning them more closely with current market trends and institutional strategies. Still, implementation details, especially around fiduciary duties and investor protections, will be crucial in determining how widely these assets are adopted in 401(k) plans.

The post Trump Greenlights Alternative Assets in 401(k) Plans first appeared on BlockNews.

TRUMP: TO SIGN ORDER ALLOWING CRYPTO IN 401K RETIREMENT PLANS LATER TODAY

TRUMP: TO SIGN ORDER ALLOWING CRYPTO IN 401K RETIREMENT PLANS LATER TODAY