Ether Dips as Validator Exit Queue Hits 18-Month High—What’s Really Going On?

- Ethereum’s validator exit queue just hit 644K ETH, sparking concerns—but much of it could be restaking or profit-taking, not panic selling.

- Despite the dip, ETH is still up 50% over the month, with $2.5B+ in ETF inflows and rising interest from institutional players.

- Lido’s stETH briefly depegged after Justin Sun withdrew $600M from Aave, rattling some DeFi users and possibly fueling more exits.

Ether just took a bit of a tumble—dropping more than 7% from its 2025 peak—as a wave of validators lined up to pull their stake. On Wednesday, Ethereum’s exit queue hit levels we haven’t seen in nearly a year and a half, and it’s got folks scratching their heads.

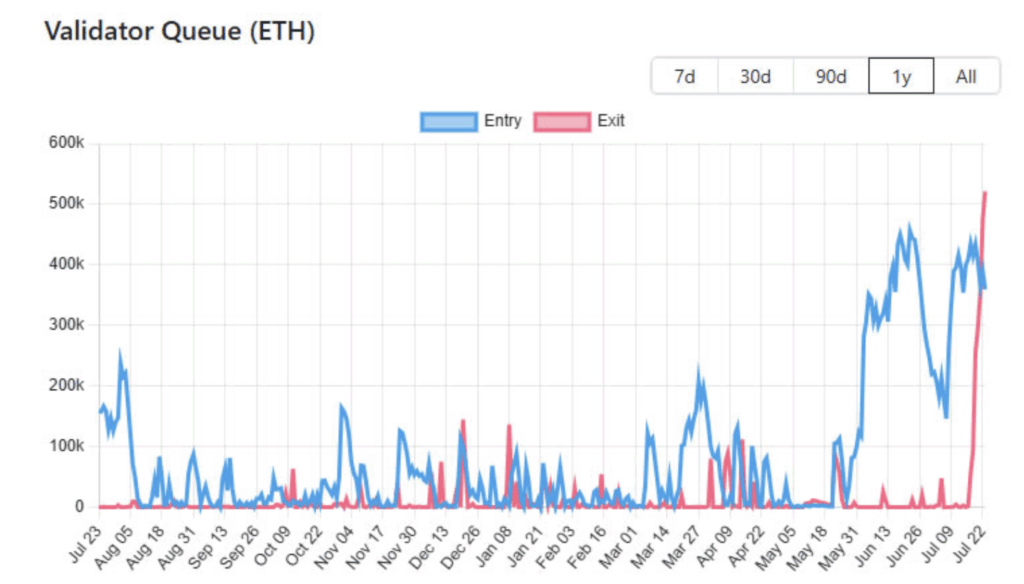

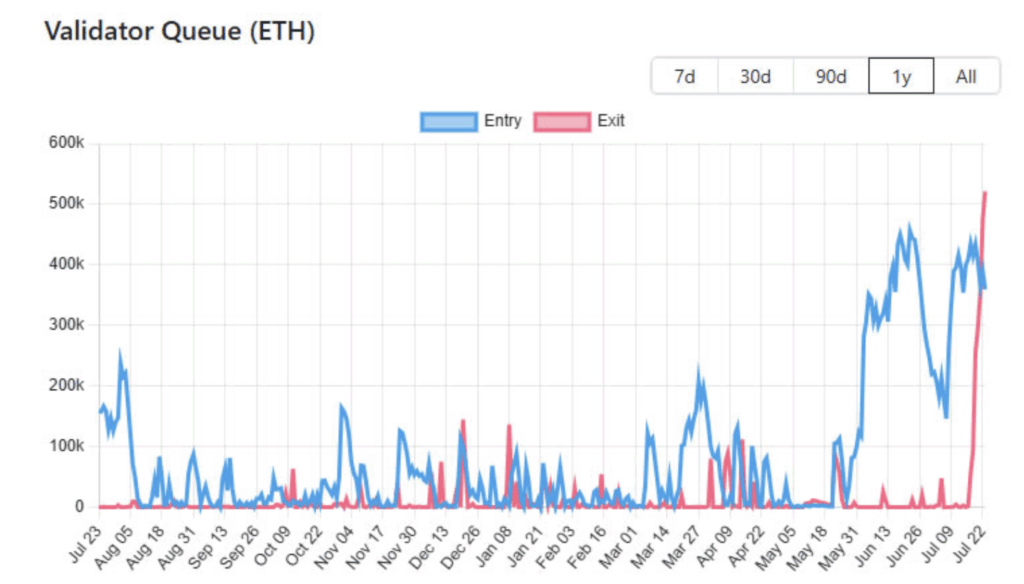

Ethereum runs on a proof-of-stake model, right? So validators need to lock up ETH to keep the network secure. But when they want out, they enter a waiting line. Lately, that line’s been exploding. According to Everstake, “the number has absolutely surged” this week—and yeah, it’s catching attention.

Right now, over 644,000 ETH—worth around $2.34 billion—is queued up to exit. That’s an 11-day wait. The last time we saw a spike like this? January 2024, when ETH slid 15% in just a couple weeks. So naturally, people are wondering—are stakers bailing out to sell?

Rotation or Just Rebalancing?

Not necessarily. Everstake says this isn’t panic. It’s more like a rotation. Some validators might be re-staking, switching operators, or just optimizing strategies. Still, a chunk of this is probably profit-takers. ETH’s been on a tear lately, and with big gains, comes big temptation to cash out—especially if you’re sitting on bags from way back.

But here’s the nuance: while 644K ETH is trying to leave, there’s also about 390K ETH—roughly $1.2B—lined up to stake. That means the net exit is only 255,000 ETH. So yeah, people are exiting… but people are also jumping in. That’s not collapse, that’s churn.

And worth noting—this entry queue’s been rising since June, around the same time firms like SharpLink and Bitmine started snatching up ETH for their treasuries. These guys are mostly planning to stake for yield. So while some money’s coming off the table, new money’s stepping in.

ETH Price Wobbles, But Still Strong

ETH hit $3,844 on Monday—its highest point in months—before dropping below $3,550 mid-week. At the time of writing, it’s back up to about $3,643. So yeah, a little pullback, but still riding high. The token’s up more than 50% in the past month. Not exactly bear market vibes.

Plus, spot Ether ETFs in the U.S. have been sucking up demand—$2.5 billion worth of inflows in just six days. And this is without a staking ETF even being approved yet. Henrik Andersson from Apollo Capital put it bluntly: “We’ve seen $8 billion in net inflows through DeFi bridges, and ETF inflows continue climbing.” In short? Institutions are sniffing around.

Lido’s stETH Wobbles After Justin Sun’s Exit

Adding a bit of drama—Tron founder Justin Sun yanked out $600M of ETH from Aave recently. That big move caused Lido’s staked ETH token (stETH) to briefly depeg. Liquidity dried up fast, and it spooked some yield farmers into either swapping stETH back to ETH or dumping it outright.

According to Marcin Kazmierczak over at RedStone, this may have played into the exit queue spike too. Some people probably saw the stETH wobble and decided to make moves before things got worse. Classic DeFi jitters.

The post Ether Dips as Validator Exit Queue Hits 18-Month High—What’s Really Going On? first appeared on BlockNews.

Ether Dips as Validator Exit Queue Hits 18-Month High—What’s Really Going On?

- Ethereum’s validator exit queue just hit 644K ETH, sparking concerns—but much of it could be restaking or profit-taking, not panic selling.

- Despite the dip, ETH is still up 50% over the month, with $2.5B+ in ETF inflows and rising interest from institutional players.

- Lido’s stETH briefly depegged after Justin Sun withdrew $600M from Aave, rattling some DeFi users and possibly fueling more exits.

Ether just took a bit of a tumble—dropping more than 7% from its 2025 peak—as a wave of validators lined up to pull their stake. On Wednesday, Ethereum’s exit queue hit levels we haven’t seen in nearly a year and a half, and it’s got folks scratching their heads.

Ethereum runs on a proof-of-stake model, right? So validators need to lock up ETH to keep the network secure. But when they want out, they enter a waiting line. Lately, that line’s been exploding. According to Everstake, “the number has absolutely surged” this week—and yeah, it’s catching attention.

Right now, over 644,000 ETH—worth around $2.34 billion—is queued up to exit. That’s an 11-day wait. The last time we saw a spike like this? January 2024, when ETH slid 15% in just a couple weeks. So naturally, people are wondering—are stakers bailing out to sell?

Rotation or Just Rebalancing?

Not necessarily. Everstake says this isn’t panic. It’s more like a rotation. Some validators might be re-staking, switching operators, or just optimizing strategies. Still, a chunk of this is probably profit-takers. ETH’s been on a tear lately, and with big gains, comes big temptation to cash out—especially if you’re sitting on bags from way back.

But here’s the nuance: while 644K ETH is trying to leave, there’s also about 390K ETH—roughly $1.2B—lined up to stake. That means the net exit is only 255,000 ETH. So yeah, people are exiting… but people are also jumping in. That’s not collapse, that’s churn.

And worth noting—this entry queue’s been rising since June, around the same time firms like SharpLink and Bitmine started snatching up ETH for their treasuries. These guys are mostly planning to stake for yield. So while some money’s coming off the table, new money’s stepping in.

ETH Price Wobbles, But Still Strong

ETH hit $3,844 on Monday—its highest point in months—before dropping below $3,550 mid-week. At the time of writing, it’s back up to about $3,643. So yeah, a little pullback, but still riding high. The token’s up more than 50% in the past month. Not exactly bear market vibes.

Plus, spot Ether ETFs in the U.S. have been sucking up demand—$2.5 billion worth of inflows in just six days. And this is without a staking ETF even being approved yet. Henrik Andersson from Apollo Capital put it bluntly: “We’ve seen $8 billion in net inflows through DeFi bridges, and ETF inflows continue climbing.” In short? Institutions are sniffing around.

Lido’s stETH Wobbles After Justin Sun’s Exit

Adding a bit of drama—Tron founder Justin Sun yanked out $600M of ETH from Aave recently. That big move caused Lido’s staked ETH token (stETH) to briefly depeg. Liquidity dried up fast, and it spooked some yield farmers into either swapping stETH back to ETH or dumping it outright.

According to Marcin Kazmierczak over at RedStone, this may have played into the exit queue spike too. Some people probably saw the stETH wobble and decided to make moves before things got worse. Classic DeFi jitters.

The post Ether Dips as Validator Exit Queue Hits 18-Month High—What’s Really Going On? first appeared on BlockNews.