Ethereum Transactions Hit Record High

- Ethereum daily transactions hit a record 1.74M, driven by a surge in staked ETH and SEC clarity on liquid staking.

- Institutional treasuries now hold $11.77B in ETH, with major companies leading the charge.

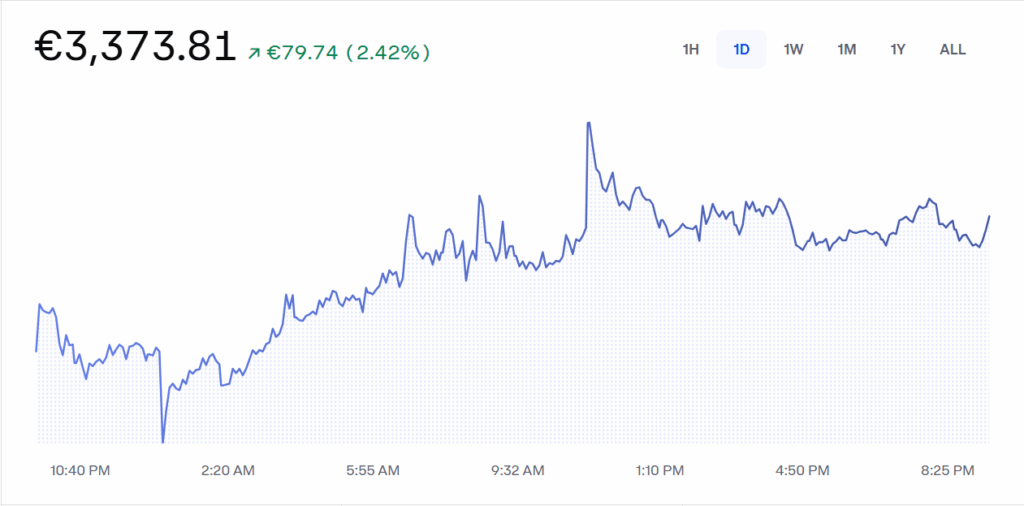

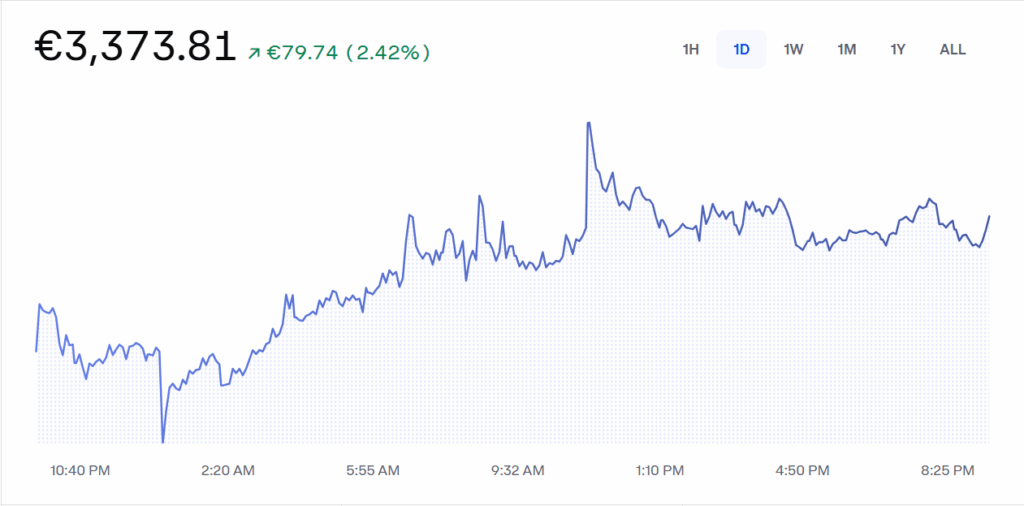

- ETH has rallied 163% since April, nearing $4K as staking locks up 30% of total supply.

Ethereum network activity has surged to unprecedented levels, with the seven-day average of daily transactions reaching 1.74 million — surpassing the previous all-time high of 1.65 million from May 2021. This spike coincides with a record 36 million ETH staked, representing nearly 30% of total supply. The growth has been fueled in part by a significant regulatory boost from the U.S. SEC, which clarified that certain liquid staking operations and staking receipt tokens do not qualify as securities under the 1933 Securities Act when meeting strict criteria. This clarity has lowered legal uncertainty, opening the door for more institutional participation in ETH staking.

Regulatory Clarity Boosts Staking and Institutional Demand

The SEC’s stance has reassured platforms and investors that they can offer liquid staking products without running afoul of securities laws, encouraging greater adoption. As more ETH is locked in staking contracts, circulating supply decreases, creating upward pressure on prices. The reduced liquidity combined with growing yields has helped push ETH close to the $4,000 level for the first time since December, marking a 163% rally from its April low of $1,470.

Institutional Treasury Holdings Grow

Institutional and corporate treasury allocations to ETH are expanding, now totaling $11.77 billion. Leaders include BitMine Immersion Technologies with 833,100 ETH ($3.2B), SharpLink Gaming with $2B, and The Ether Machine with $1.34B. Ethereum co-founder Vitalik Buterin endorsed the trend, stating that ETH in treasuries offers valuable diversification options, though he cautioned against excessive leverage, referencing risks similar to the Terra collapse.

Market Outlook and Staking Momentum

More than 500,000 ETH, worth approximately $1.8 billion, was staked in just the first half of June, reflecting rising confidence in the network and a persistent decline in liquid supply. Analysts suggest that the combination of favorable regulation, institutional adoption, and decreasing available supply could sustain Ethereum’s bullish momentum. However, Buterin warned that improper risk management — particularly through overleveraged treasury strategies — could undermine this growth in the long term.

The post Ethereum Transactions Hit Record High first appeared on BlockNews.

Ethereum Transactions Hit Record High

- Ethereum daily transactions hit a record 1.74M, driven by a surge in staked ETH and SEC clarity on liquid staking.

- Institutional treasuries now hold $11.77B in ETH, with major companies leading the charge.

- ETH has rallied 163% since April, nearing $4K as staking locks up 30% of total supply.

Ethereum network activity has surged to unprecedented levels, with the seven-day average of daily transactions reaching 1.74 million — surpassing the previous all-time high of 1.65 million from May 2021. This spike coincides with a record 36 million ETH staked, representing nearly 30% of total supply. The growth has been fueled in part by a significant regulatory boost from the U.S. SEC, which clarified that certain liquid staking operations and staking receipt tokens do not qualify as securities under the 1933 Securities Act when meeting strict criteria. This clarity has lowered legal uncertainty, opening the door for more institutional participation in ETH staking.

Regulatory Clarity Boosts Staking and Institutional Demand

The SEC’s stance has reassured platforms and investors that they can offer liquid staking products without running afoul of securities laws, encouraging greater adoption. As more ETH is locked in staking contracts, circulating supply decreases, creating upward pressure on prices. The reduced liquidity combined with growing yields has helped push ETH close to the $4,000 level for the first time since December, marking a 163% rally from its April low of $1,470.

Institutional Treasury Holdings Grow

Institutional and corporate treasury allocations to ETH are expanding, now totaling $11.77 billion. Leaders include BitMine Immersion Technologies with 833,100 ETH ($3.2B), SharpLink Gaming with $2B, and The Ether Machine with $1.34B. Ethereum co-founder Vitalik Buterin endorsed the trend, stating that ETH in treasuries offers valuable diversification options, though he cautioned against excessive leverage, referencing risks similar to the Terra collapse.

Market Outlook and Staking Momentum

More than 500,000 ETH, worth approximately $1.8 billion, was staked in just the first half of June, reflecting rising confidence in the network and a persistent decline in liquid supply. Analysts suggest that the combination of favorable regulation, institutional adoption, and decreasing available supply could sustain Ethereum’s bullish momentum. However, Buterin warned that improper risk management — particularly through overleveraged treasury strategies — could undermine this growth in the long term.

The post Ethereum Transactions Hit Record High first appeared on BlockNews.