Solana Smashes Through $200 as Bulls Charge Back In

- Solana broke $200 for the first time in five months, locking in $538M in realized gains and hitting $105B market cap.

- ETF momentum and staking activity have driven institutional inflows, with funds like REX-Osprey SOL + Staking drawing attention.

- Derivatives markets show surging speculation, and wallet creation is booming—suggesting both fresh demand and a potential move toward $250+.

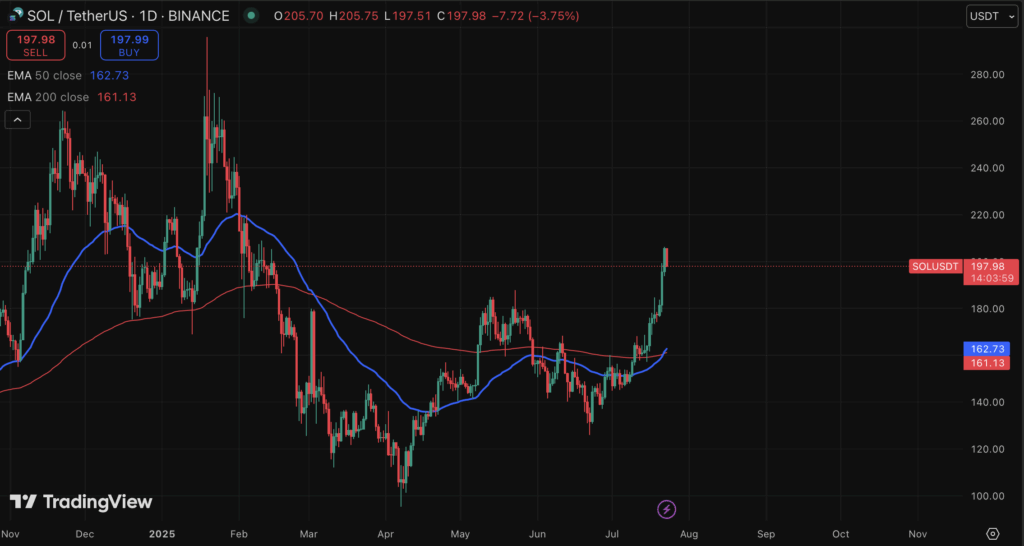

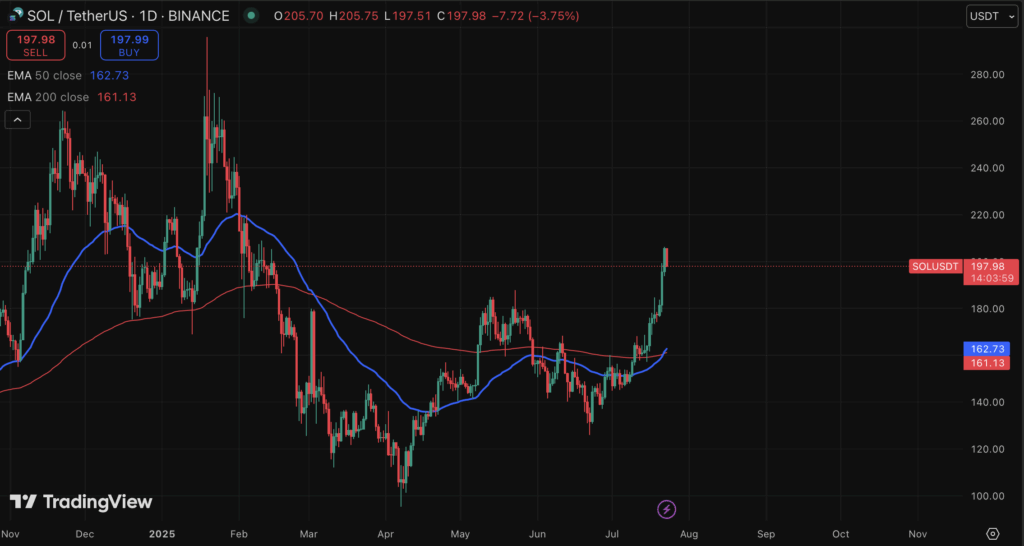

Solana just did something it hasn’t done in a while—blast past $200. Yep, first time in five months. It pushed as high as $200 flat before settling down around $197, which, all things considered, is still pretty wild. The daily close on July 21? A solid $195. Best closing price since… early 2025.

That day alone, SOL locked in a 7.88% gain. And more importantly? About $538 million in realized gains. That’s the biggest two-month haul in a while—so, yeah, it looks like long-dormant bags are finally waking up.

Even the day after was no slouch. Solana moved 4.6% intraday, showing there’s still fuel in the tank. Market cap? It’s now back above $105 billion. That puts it ahead of companies like Intel, which is kind of nuts when you think about it.

Staking Up, TVL Climbing, and the Chain’s Still Cooking

Solana’s network has been buzzing. Total Value Locked (TVL) surged—almost $800 million in inflows hit the network recently. TVL now sits just shy of $10 billion. It hasn’t been at that level in almost six months.

That TVL jump? It’s not just hype—it comes with staking spikes and fresh capital rotating in fast. SOL’s been on a heater, up 23% over the past week alone.

ETF Buzz Sends Institutions Scrambling

Here’s where things get even spicier. Traders on prediction markets are now pricing in a 99% chance of a spot Solana ETF landing sometime in 2025. With some SEC green lights and eager asset managers, that doesn’t feel far off.

In fact, the REX-Osprey SOL and SOL Staking ETFs already got the automatic thumbs-up. They’re live. And the SOL + Staking fund is pulling in capital fast—almost $100 million already. The staking model, especially, is catching big investors’ eyes.

Meanwhile, Nasdaq-listed Upexi scooped up 100K SOL. DeFi Development Corp? They bought nearly a million and are validating on-chain now. Institutions clearly want in.

Technicals Flash Green, Eyes on $250 Next?

There’s a strong technical case here too. Solana broke out of an inverse head-and-shoulders pattern above $159. That’s bullish city. The first target was $185–$210. It’s already touching that zone.

If momentum keeps up, $220–$250 is on the table. A stretch target? $300 isn’t crazy if the rally keeps pace.

That breakout also cleared a major supply wall at $185. Most of the underwater crowd from earlier cycles is now in profit. The $538 million in gains so far might just be the start.

New Wallets, Big Derivatives Action, and Rising Volatility

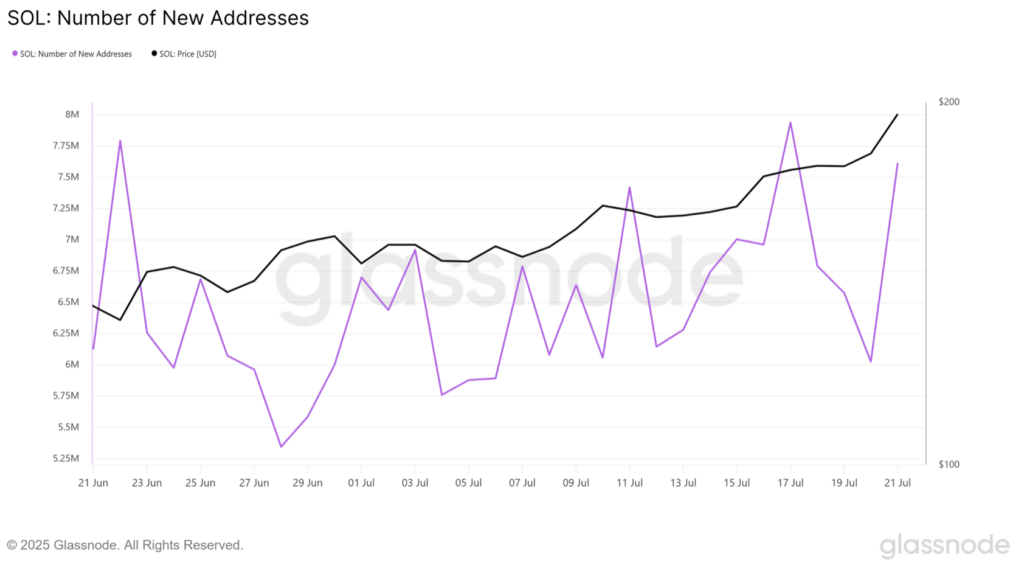

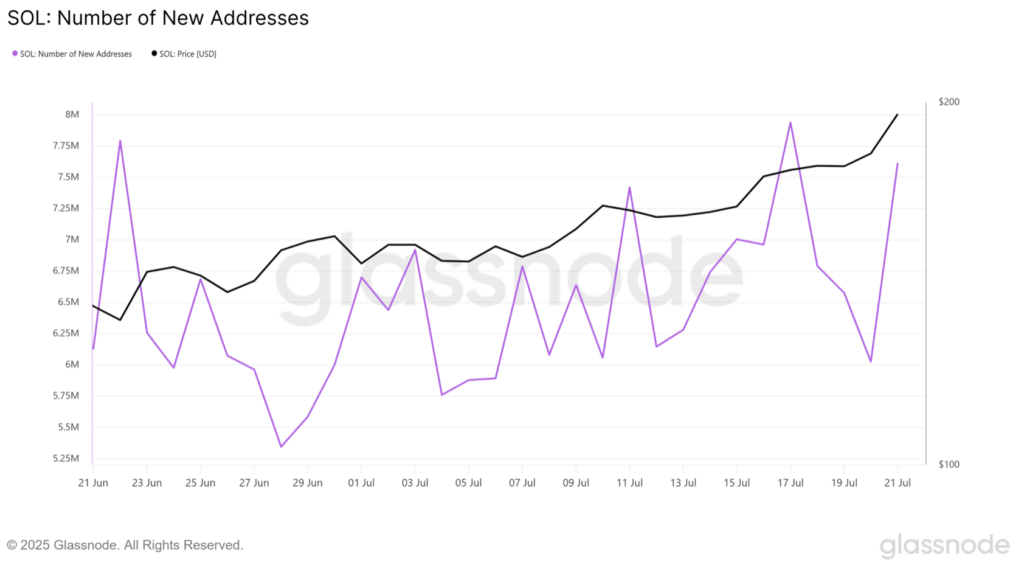

Glassnode data shows that as SOL approached $195, wallet creation spiked 26%. Around 1.5 million new addresses popped up—people want in. This isn’t just traders recycling positions. New money is entering.

Meanwhile, derivatives traders are piling on. Open interest in Solana futures jumped by $1.5 billion in just three days. On the CME, over $4 billion worth of SOL contracts traded recently. That’s huge.

And here’s the kicker—implied volatility spiked from 4% to 14%, meaning traders are bracing for some big swings ahead.

The post Solana Smashes Through $200 as Bulls Charge Back In first appeared on BlockNews.

Solana Smashes Through $200 as Bulls Charge Back In

- Solana broke $200 for the first time in five months, locking in $538M in realized gains and hitting $105B market cap.

- ETF momentum and staking activity have driven institutional inflows, with funds like REX-Osprey SOL + Staking drawing attention.

- Derivatives markets show surging speculation, and wallet creation is booming—suggesting both fresh demand and a potential move toward $250+.

Solana just did something it hasn’t done in a while—blast past $200. Yep, first time in five months. It pushed as high as $200 flat before settling down around $197, which, all things considered, is still pretty wild. The daily close on July 21? A solid $195. Best closing price since… early 2025.

That day alone, SOL locked in a 7.88% gain. And more importantly? About $538 million in realized gains. That’s the biggest two-month haul in a while—so, yeah, it looks like long-dormant bags are finally waking up.

Even the day after was no slouch. Solana moved 4.6% intraday, showing there’s still fuel in the tank. Market cap? It’s now back above $105 billion. That puts it ahead of companies like Intel, which is kind of nuts when you think about it.

Staking Up, TVL Climbing, and the Chain’s Still Cooking

Solana’s network has been buzzing. Total Value Locked (TVL) surged—almost $800 million in inflows hit the network recently. TVL now sits just shy of $10 billion. It hasn’t been at that level in almost six months.

That TVL jump? It’s not just hype—it comes with staking spikes and fresh capital rotating in fast. SOL’s been on a heater, up 23% over the past week alone.

ETF Buzz Sends Institutions Scrambling

Here’s where things get even spicier. Traders on prediction markets are now pricing in a 99% chance of a spot Solana ETF landing sometime in 2025. With some SEC green lights and eager asset managers, that doesn’t feel far off.

In fact, the REX-Osprey SOL and SOL Staking ETFs already got the automatic thumbs-up. They’re live. And the SOL + Staking fund is pulling in capital fast—almost $100 million already. The staking model, especially, is catching big investors’ eyes.

Meanwhile, Nasdaq-listed Upexi scooped up 100K SOL. DeFi Development Corp? They bought nearly a million and are validating on-chain now. Institutions clearly want in.

Technicals Flash Green, Eyes on $250 Next?

There’s a strong technical case here too. Solana broke out of an inverse head-and-shoulders pattern above $159. That’s bullish city. The first target was $185–$210. It’s already touching that zone.

If momentum keeps up, $220–$250 is on the table. A stretch target? $300 isn’t crazy if the rally keeps pace.

That breakout also cleared a major supply wall at $185. Most of the underwater crowd from earlier cycles is now in profit. The $538 million in gains so far might just be the start.

New Wallets, Big Derivatives Action, and Rising Volatility

Glassnode data shows that as SOL approached $195, wallet creation spiked 26%. Around 1.5 million new addresses popped up—people want in. This isn’t just traders recycling positions. New money is entering.

Meanwhile, derivatives traders are piling on. Open interest in Solana futures jumped by $1.5 billion in just three days. On the CME, over $4 billion worth of SOL contracts traded recently. That’s huge.

And here’s the kicker—implied volatility spiked from 4% to 14%, meaning traders are bracing for some big swings ahead.

The post Solana Smashes Through $200 as Bulls Charge Back In first appeared on BlockNews.