Upbit Announces Ethena (ENA) Listing, Token Explodes 20%

South Korean crypto exchange Upbit has officially announced the listing of Ethena ENA $0.32 24h volatility: 10.0% Market cap: $2.01 B Vol. 24h: $374.42 M on its KRW, BTC BTC $115 951 24h volatility: 4.2% Market cap: $2.31 T Vol. 24h: $56.12 B , and USDT USDT $1.00 24h volatility: 0.0% Market cap: $158.79 B Vol. 24h: $115.07 B markets, sparking a massive price rally of over 20% within hours.

Trading support for ENA will commence at 17:00 KST on July 11, with deposits enabled shortly after the announcement.

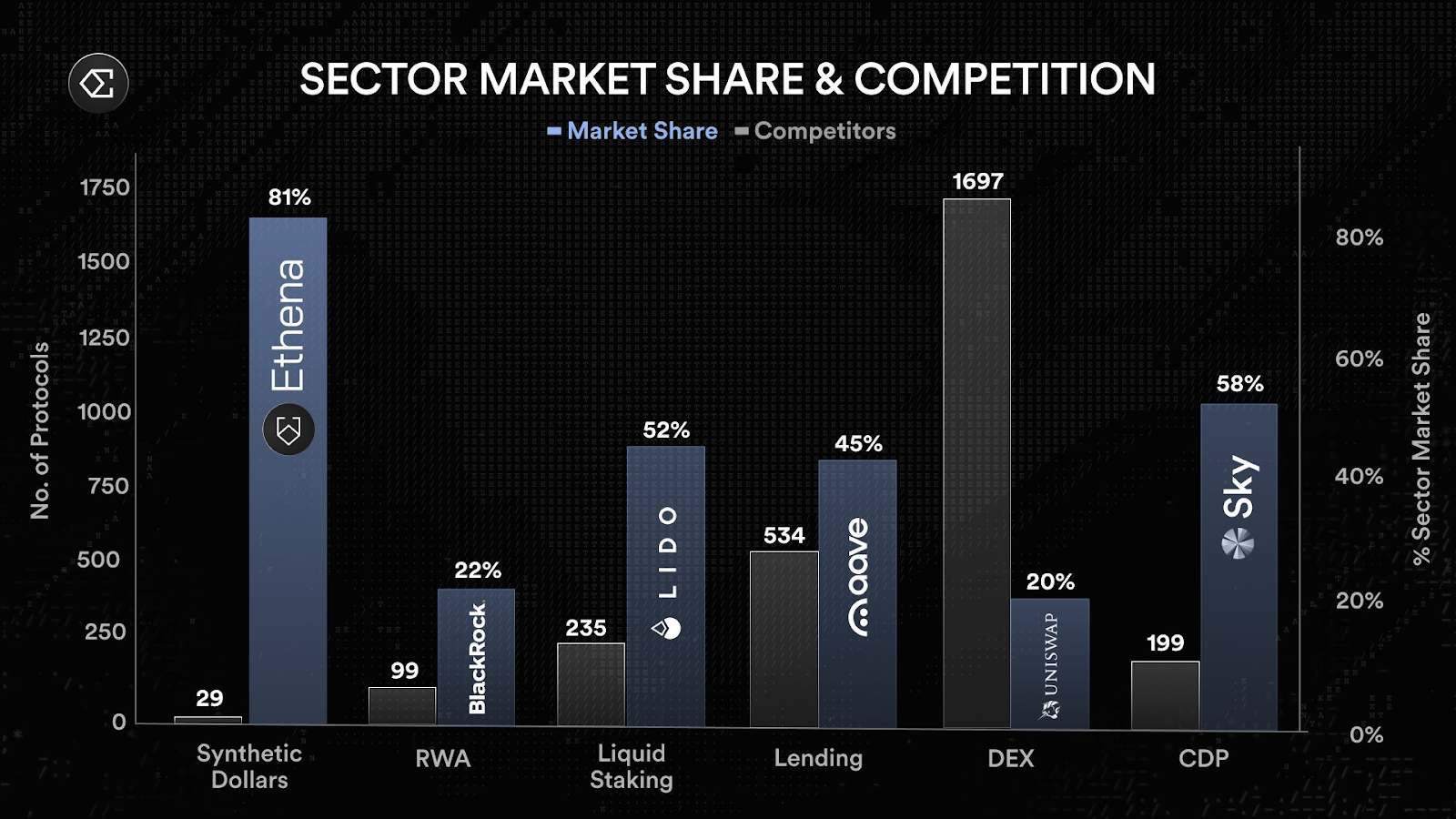

Ethena’s Sector Dominance

The listing comes amid Ethena’s rising dominance in the synthetic dollar sector and rising number of investors looking for the best crypto to buy.

A chart shared by Conor Ryder, Head of Research at Ethena Labs, highlights ENA’s staggering 81% market share in a sector with just 29 protocols.

$ENA is listed on Upbit @upbitglobal, the largest South Korean exchange

업비트 원화 마켓에 $ENA 가 상장되었습니다

주요 한국 거래소에 또 상장하게 되어 매우 기쁩니다 pic.twitter.com/P1dktBReXx

— Ethena Labs (@ethena_labs) July 11, 2025

This level of dominance is unmatched across DeFi verticals, surpassing even the likes of Uniswap (20% share in DEXs with 1,697 competitors) and Aave (45% share in Lending with 534 protocols).

Sector Market Share | Source: Conor Ryder

“Synthetic dollars/perp funding rates are one of the few opportunities in the industry today that can generate >$1bn of revenues,” Ryder said, emphasizing the uniqueness of Ethena’s positioning. “Ethena has >80% share of the entire sector with less than 30 competitors. Billions will flow to the winner.”

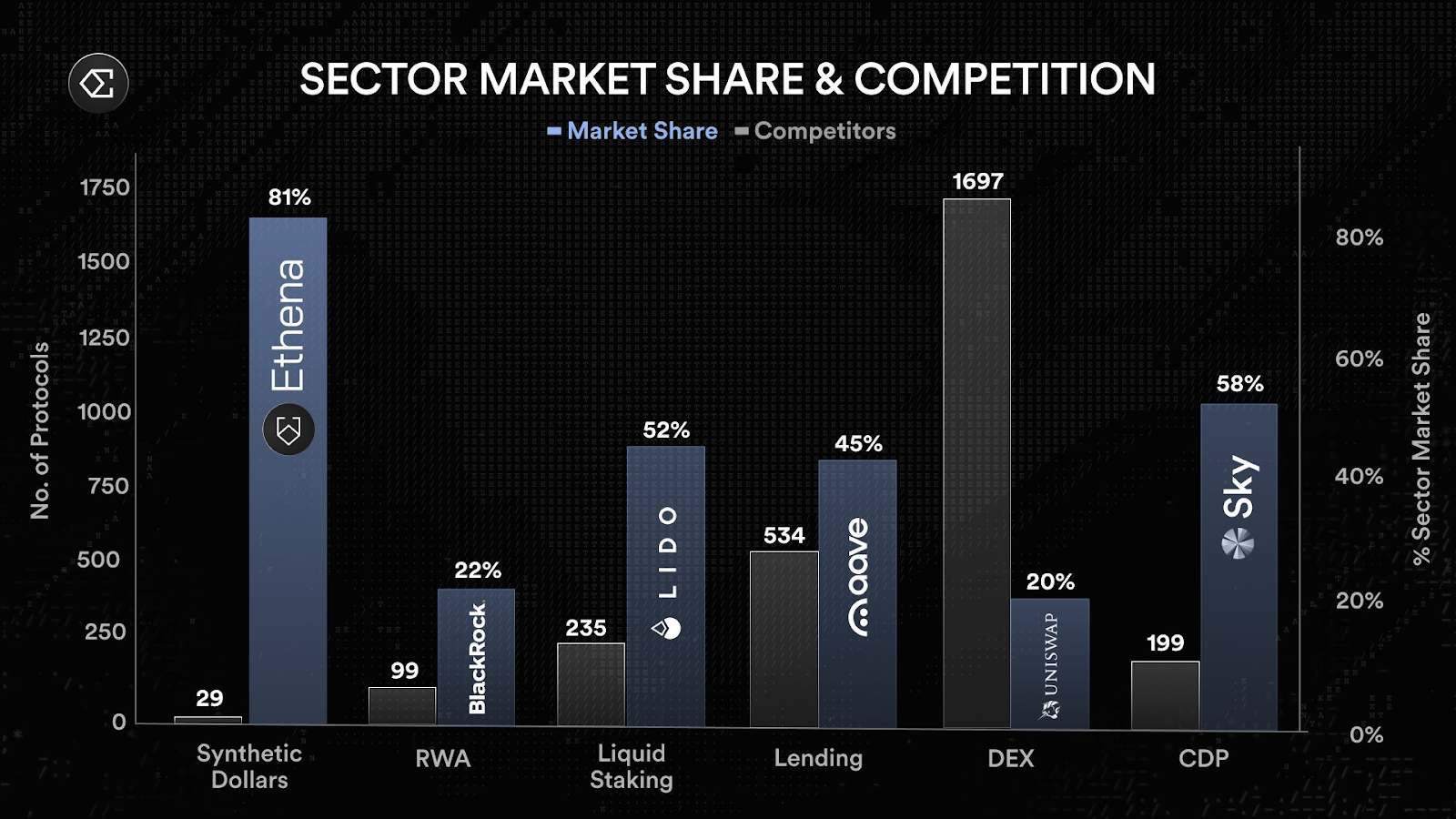

ENA Price Analysis: ENA/USDT Soars on Momentum

Following Upbit’s listing news, ENA surged by 20%, climbing from $0.3176 to a session high of $0.3900 before settling at $0.3634 at press time.

The price has erupted above the upper Bollinger Band ($0.3282), indicating a strong breakout from consolidation. The middle band ($0.2758) now acts as near-term support.

Meanwhile, the RSI is sitting at 89.80, an extremely overbought condition. The MACD line (blue) has crossed significantly above the signal line (signal), confirming bullish momentum.

ENA Daily Chart with Momentum Indicators | Source: TradingView

Finally, the Balance of Power is at 0.57, showing buyers are in full control of the market, a healthy sign of accumulation.

Based on the current trajectory, ENA could retest the immediate resistance at $0.3900 once again with a breakout target in the $0.42–$0.45 range.

Also, any minor correction could present a buying opportunity if the price remains above the $0.30 psychological level and continues to hold its breakout range.

The post Upbit Announces Ethena (ENA) Listing, Token Explodes 20% appeared first on Coinspeaker.

Upbit Announces Ethena (ENA) Listing, Token Explodes 20%

South Korean crypto exchange Upbit has officially announced the listing of Ethena ENA $0.32 24h volatility: 10.0% Market cap: $2.01 B Vol. 24h: $374.42 M on its KRW, BTC BTC $115 951 24h volatility: 4.2% Market cap: $2.31 T Vol. 24h: $56.12 B , and USDT USDT $1.00 24h volatility: 0.0% Market cap: $158.79 B Vol. 24h: $115.07 B markets, sparking a massive price rally of over 20% within hours.

Trading support for ENA will commence at 17:00 KST on July 11, with deposits enabled shortly after the announcement.

Ethena’s Sector Dominance

The listing comes amid Ethena’s rising dominance in the synthetic dollar sector and rising number of investors looking for the best crypto to buy.

A chart shared by Conor Ryder, Head of Research at Ethena Labs, highlights ENA’s staggering 81% market share in a sector with just 29 protocols.

$ENA is listed on Upbit @upbitglobal, the largest South Korean exchange

업비트 원화 마켓에 $ENA 가 상장되었습니다

주요 한국 거래소에 또 상장하게 되어 매우 기쁩니다 pic.twitter.com/P1dktBReXx

— Ethena Labs (@ethena_labs) July 11, 2025

This level of dominance is unmatched across DeFi verticals, surpassing even the likes of Uniswap (20% share in DEXs with 1,697 competitors) and Aave (45% share in Lending with 534 protocols).

Sector Market Share | Source: Conor Ryder

“Synthetic dollars/perp funding rates are one of the few opportunities in the industry today that can generate >$1bn of revenues,” Ryder said, emphasizing the uniqueness of Ethena’s positioning. “Ethena has >80% share of the entire sector with less than 30 competitors. Billions will flow to the winner.”

ENA Price Analysis: ENA/USDT Soars on Momentum

Following Upbit’s listing news, ENA surged by 20%, climbing from $0.3176 to a session high of $0.3900 before settling at $0.3634 at press time.

The price has erupted above the upper Bollinger Band ($0.3282), indicating a strong breakout from consolidation. The middle band ($0.2758) now acts as near-term support.

Meanwhile, the RSI is sitting at 89.80, an extremely overbought condition. The MACD line (blue) has crossed significantly above the signal line (signal), confirming bullish momentum.

ENA Daily Chart with Momentum Indicators | Source: TradingView

Finally, the Balance of Power is at 0.57, showing buyers are in full control of the market, a healthy sign of accumulation.

Based on the current trajectory, ENA could retest the immediate resistance at $0.3900 once again with a breakout target in the $0.42–$0.45 range.

Also, any minor correction could present a buying opportunity if the price remains above the $0.30 psychological level and continues to hold its breakout range.

The post Upbit Announces Ethena (ENA) Listing, Token Explodes 20% appeared first on Coinspeaker.