Warren Buffett’s $330B Portfolio Holds 58% in Just 4 Power Stocks

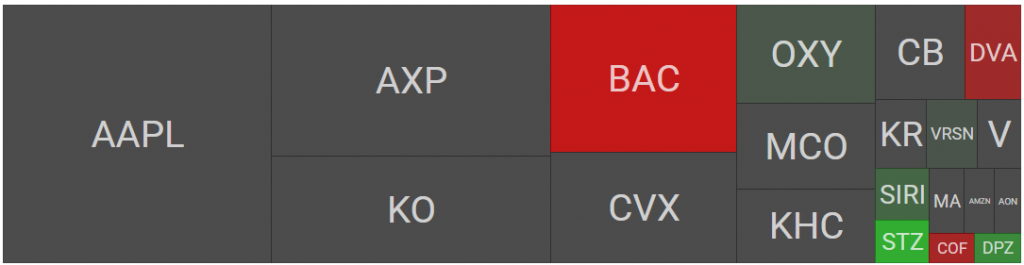

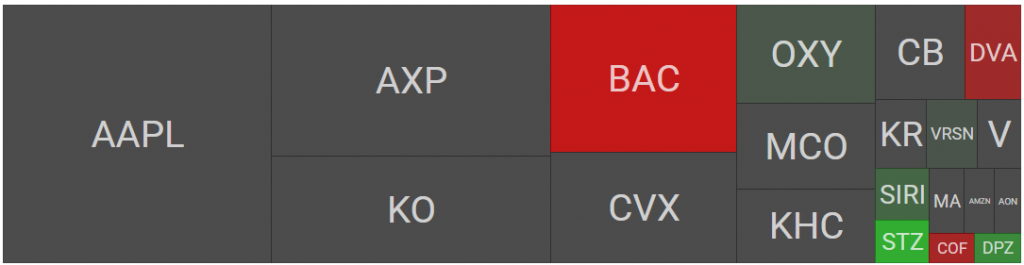

Warren Buffett portfolio reveals 58% concentration in Apple stock, Bank of America, American Express, and Coca-Cola stock. The $287 billion Berkshire Hathaway portfolio demonstrates focused blue-chip stocks investing drives exceptional returns through long-term investing strategies.

Also Read: Ethereum Whale Makes $23 Million Profit Amid 49% Rally

How Buffett’s Top 4 Stocks Drive the $330B Berkshire Portfolio

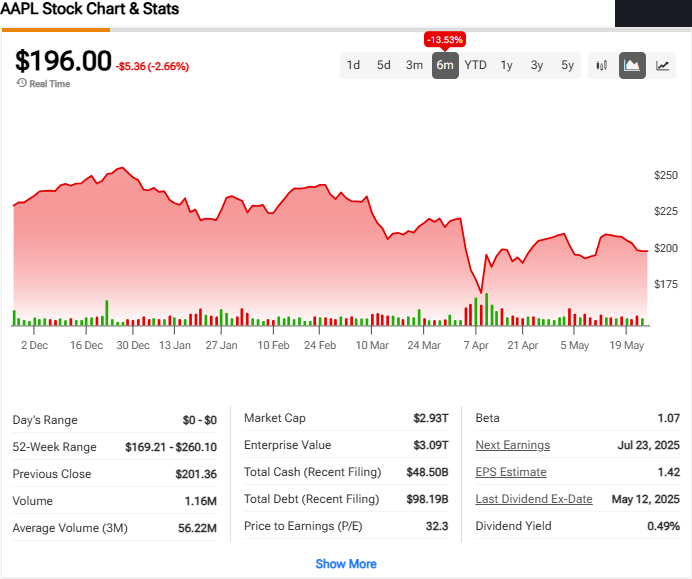

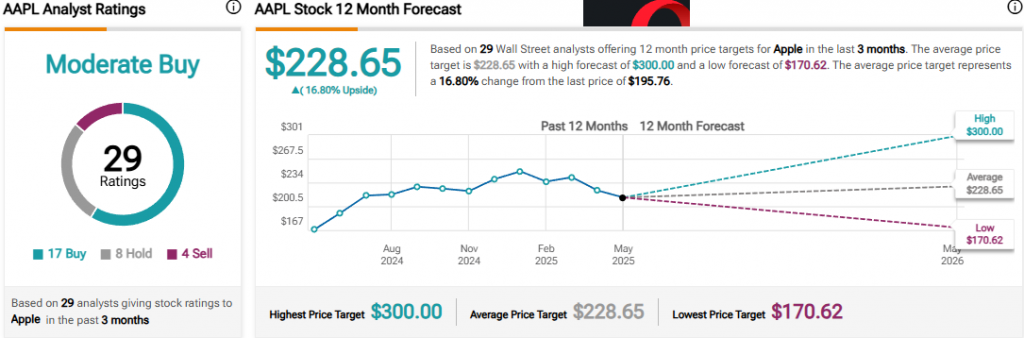

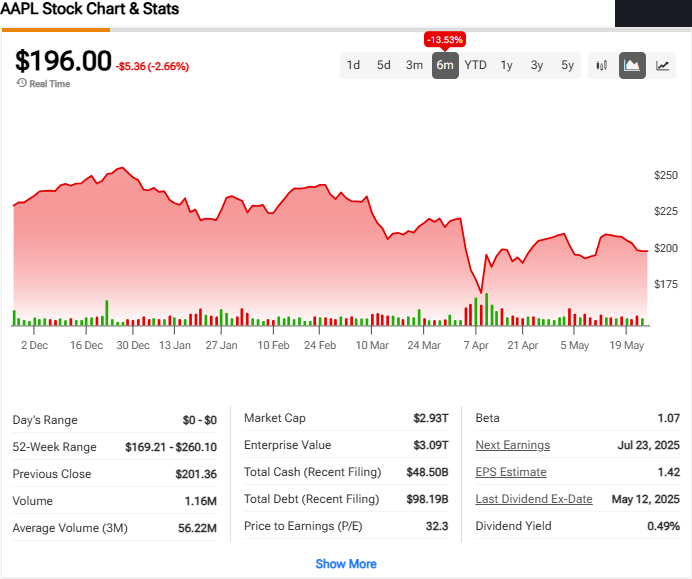

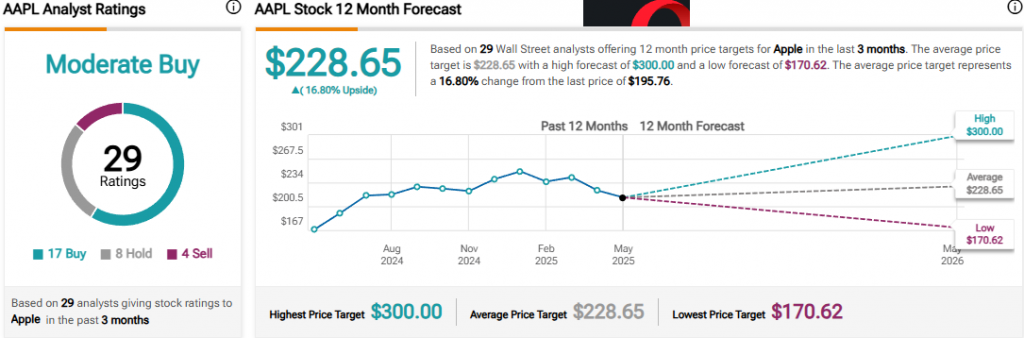

1. Apple Stock Dominates Warren Buffett Portfolio

Apple stock represents $63.4 billion of the Warren Buffett portfolio at 22.1%. Despite reducing from 915 million to 300 million shares, Apple stock remains Berkshire’s largest holding. Customer loyalty and premium pricing attracted Buffett to this long-term investing play. The tech giant’s $775 billion buyback program since 2013 helps grow Berkshire’s stake without additional Warren Buffett portfolio purchases.

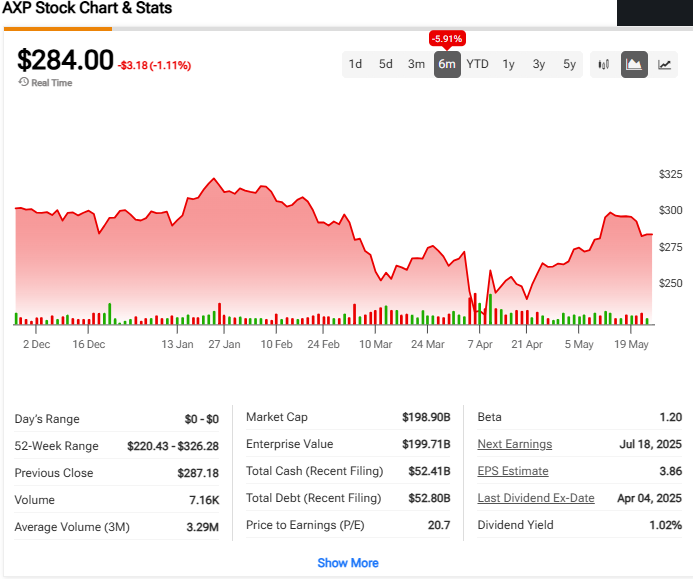

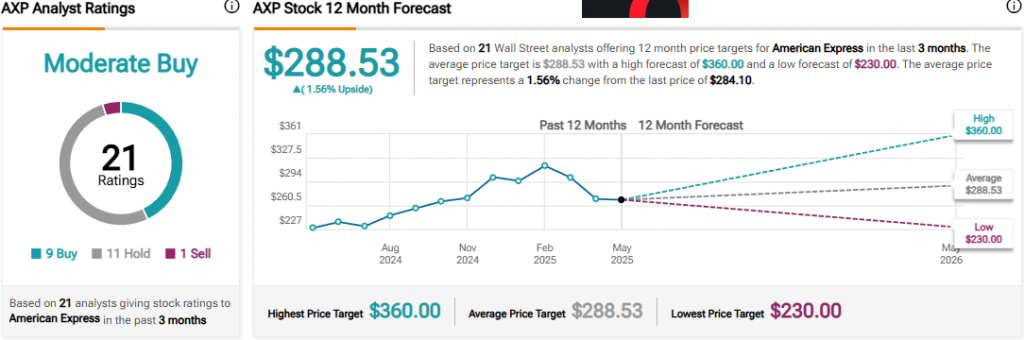

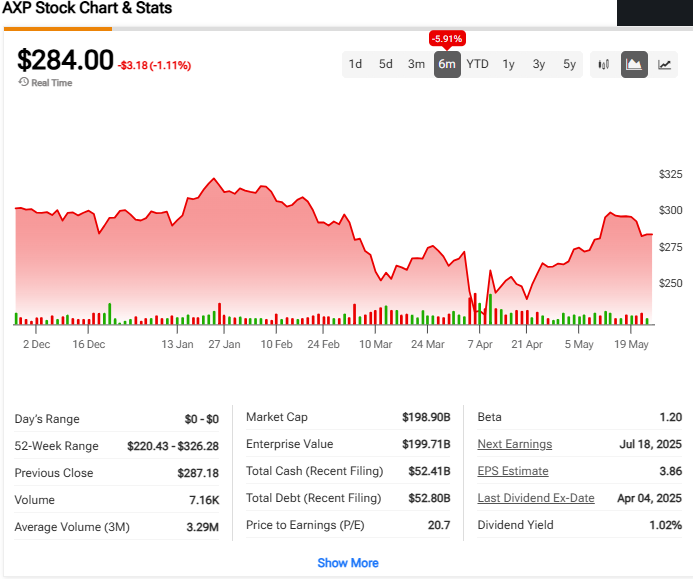

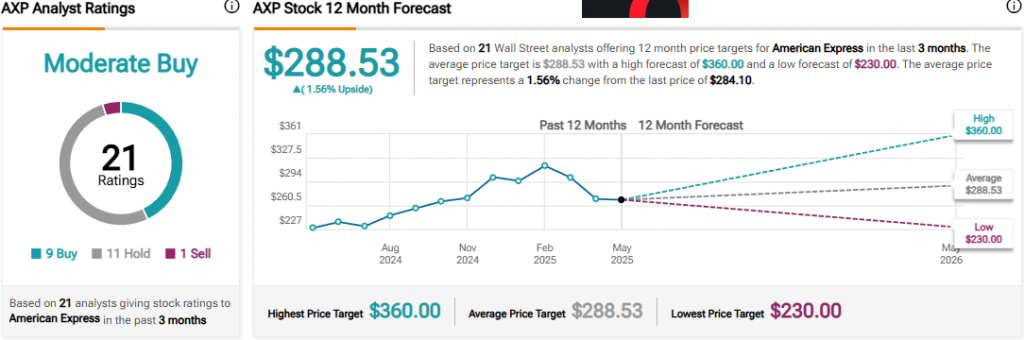

2. American Express Powers Returns

American Express commands $45.4 billion of the Warren Buffett portfolio as an “indefinite” holding since 1991. This financial sector stock benefits from merchant fees and cardholder interest income streams. American Express delivers 38.6% yield on cost with $3.28 dividends on $8.49 basis, showcasing dividend stocks performance.

Also Read: If You Bought $2,000 of Bitcoin & Gold in 2010, Which Is More Profitable Today?

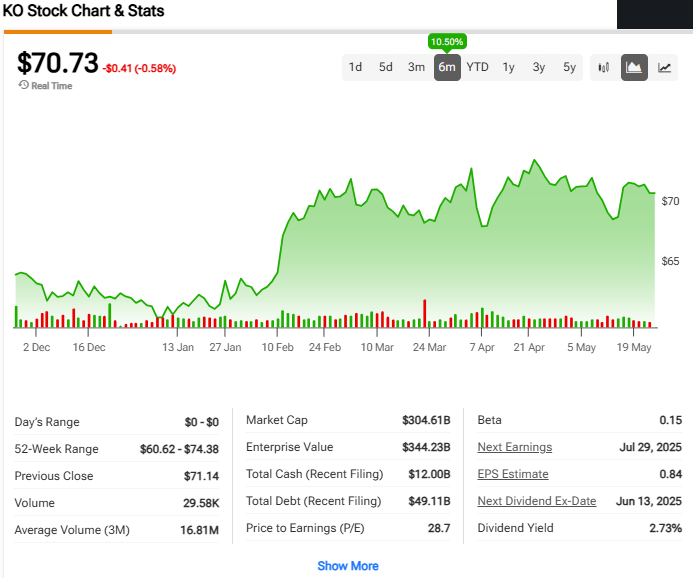

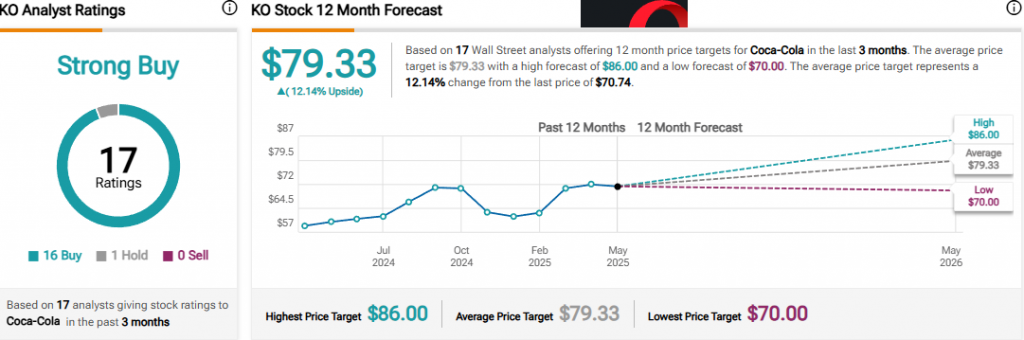

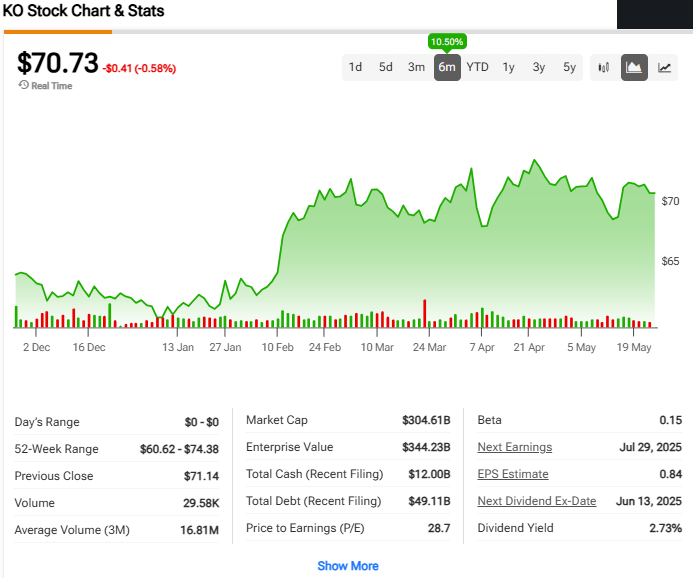

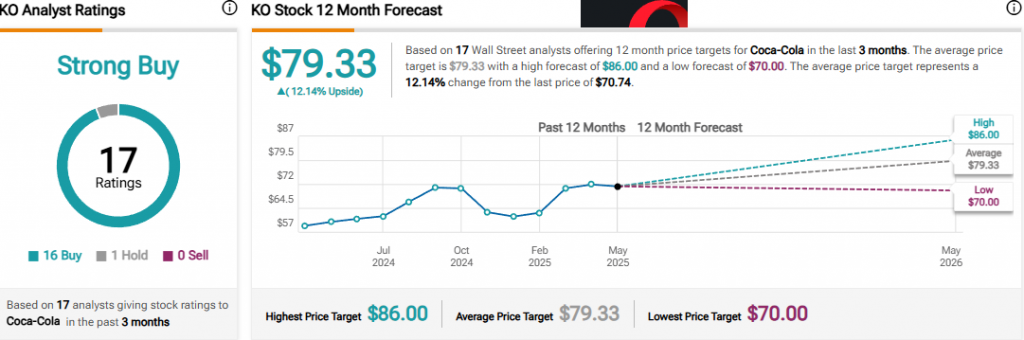

3. Coca-Cola Stock Anchors Dividend Strategy

Coca-Cola stock worth $28.8 billion anchors the Warren Buffett portfolio since 1988. This dividend stocks champion increased payouts 63 consecutive years across global operations. Berkshire’s Coca-Cola stock generates 62.8% yield on cost through $2.04 dividends on 400 million shares at $3.2475 basis.

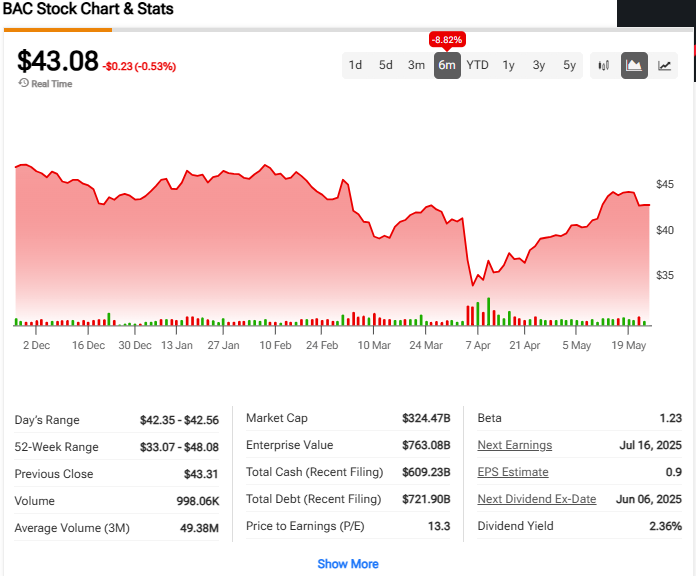

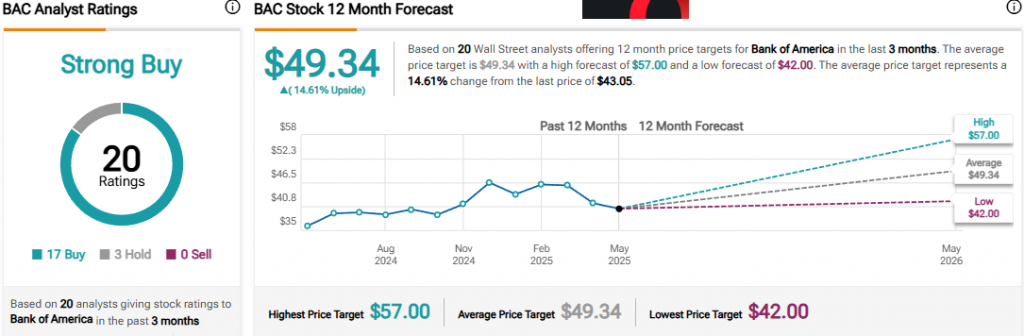

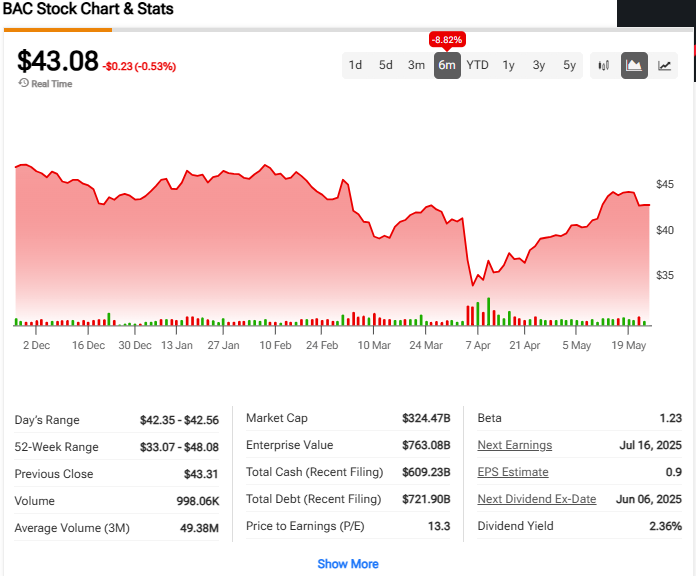

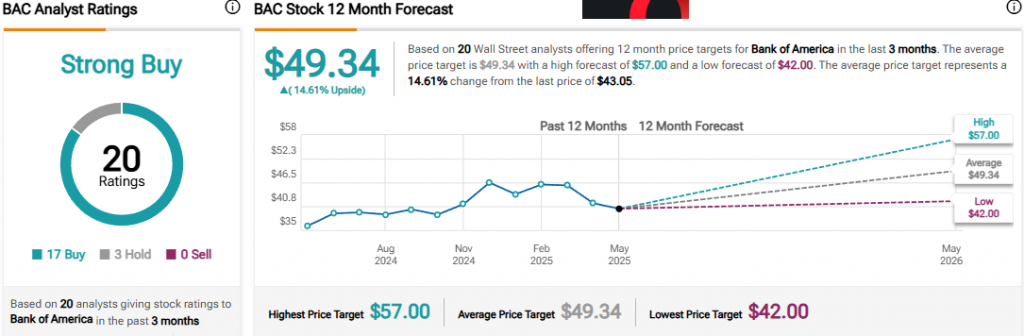

4. Bank of America Completes Core Holdings

Warren Buffett still owns around $28.2 billion of Bank of America stock. He sold 48.6 million shares but kept most of it. Bank of America does really well when interest rates go up – better than other big banks. The bank gives shareholders $1.04 per share each year. They also bought back a bunch of their own stock – about 29% since 2017. This means fewer shares are out there, so each share is worth more.

Also Read: Pi Network Price Forecast Till 2040: Is Pi Coin A Good Long Term Investment?

Conclusion

The Buffett portfolio concentration in these four power stocks proves focused investing in Apple stock, American Express, Coca-Cola stock, and Bank of America generates superior returns through patient blue-chip stocks allocation and disciplined long-term investing approach.

Read More

Alaska Airlines (ALK) Cancels 150+ Flights in IT Crisis, Stock Down 18% YTD

Warren Buffett’s $330B Portfolio Holds 58% in Just 4 Power Stocks

Warren Buffett portfolio reveals 58% concentration in Apple stock, Bank of America, American Express, and Coca-Cola stock. The $287 billion Berkshire Hathaway portfolio demonstrates focused blue-chip stocks investing drives exceptional returns through long-term investing strategies.

Also Read: Ethereum Whale Makes $23 Million Profit Amid 49% Rally

How Buffett’s Top 4 Stocks Drive the $330B Berkshire Portfolio

1. Apple Stock Dominates Warren Buffett Portfolio

Apple stock represents $63.4 billion of the Warren Buffett portfolio at 22.1%. Despite reducing from 915 million to 300 million shares, Apple stock remains Berkshire’s largest holding. Customer loyalty and premium pricing attracted Buffett to this long-term investing play. The tech giant’s $775 billion buyback program since 2013 helps grow Berkshire’s stake without additional Warren Buffett portfolio purchases.

2. American Express Powers Returns

American Express commands $45.4 billion of the Warren Buffett portfolio as an “indefinite” holding since 1991. This financial sector stock benefits from merchant fees and cardholder interest income streams. American Express delivers 38.6% yield on cost with $3.28 dividends on $8.49 basis, showcasing dividend stocks performance.

Also Read: If You Bought $2,000 of Bitcoin & Gold in 2010, Which Is More Profitable Today?

3. Coca-Cola Stock Anchors Dividend Strategy

Coca-Cola stock worth $28.8 billion anchors the Warren Buffett portfolio since 1988. This dividend stocks champion increased payouts 63 consecutive years across global operations. Berkshire’s Coca-Cola stock generates 62.8% yield on cost through $2.04 dividends on 400 million shares at $3.2475 basis.

4. Bank of America Completes Core Holdings

Warren Buffett still owns around $28.2 billion of Bank of America stock. He sold 48.6 million shares but kept most of it. Bank of America does really well when interest rates go up – better than other big banks. The bank gives shareholders $1.04 per share each year. They also bought back a bunch of their own stock – about 29% since 2017. This means fewer shares are out there, so each share is worth more.

Also Read: Pi Network Price Forecast Till 2040: Is Pi Coin A Good Long Term Investment?

Conclusion

The Buffett portfolio concentration in these four power stocks proves focused investing in Apple stock, American Express, Coca-Cola stock, and Bank of America generates superior returns through patient blue-chip stocks allocation and disciplined long-term investing approach.

Read More