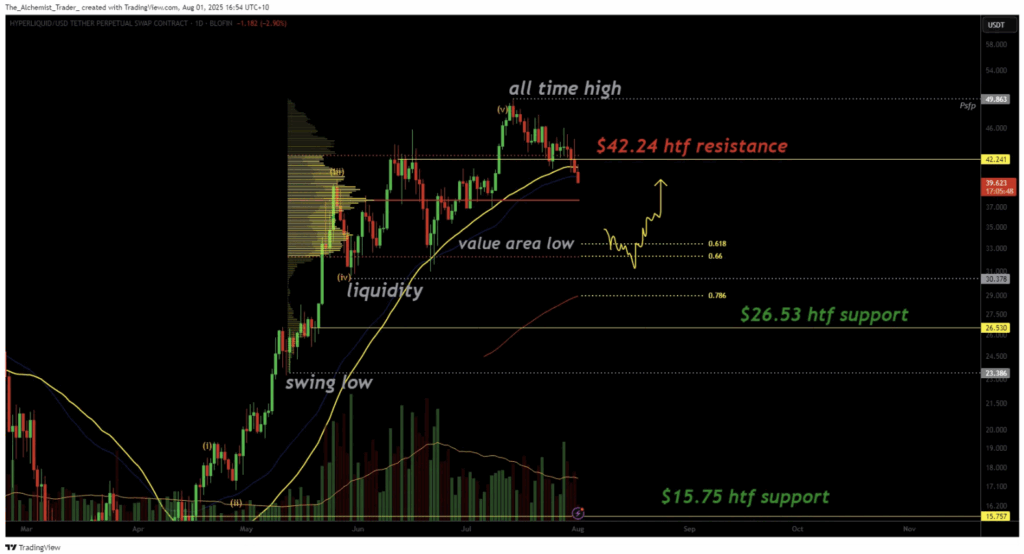

HyperLiquid Slips Below Key Resistance — Is $30 the Next Stop?

- HYPE lost the $42.24 level after a failed breakout, entering correction territory.

- Support levels to watch: Point of control (current test) and the $30 zone below.

- Volume’s fading, which increases the risk of deeper downside unless bulls step in soon.

Well… that breakout didn’t last long. HyperLiquid (HYPE) made a bold run above $42.24—setting fresh all-time highs—only to slip right back under it, losing grip on what many considered a major resistance-turned-support level. And now? The chart’s starting to look like a slow-motion retreat.

With volume drying up and price sliding, HYPE’s momentum is officially in correction mode. All eyes are on that lower support near $30. If this keeps up, we might be headed there sooner than expected.

Breakout Rejected, Correction Kicks In

After flirting with the top, HYPE fumbled the $42.24 breakout and rolled over. What should’ve been the base for a new rally turned into a fake-out—a textbook deviation that often signals more downside.

The price is now heading toward the point of control (POC), a pretty important area that hasn’t been stress-tested in this current pullback. If it doesn’t hold here, the value area low around $30 is the next likely stop. And yeah, that level’s still got a big ol’ batch of untapped liquidity.

Volume’s Drying Up — That’s Not Great

Since hitting that all-time high, trading volume has been fading. That’s… not exactly what you wanna see if you’re hoping for a recovery bounce. Without strong buy interest, every support level becomes a maybe rather than a must-hold.

If $30 doesn’t catch this fall, the next level to watch is down around $26.53. A drop that low would basically carve out a wider range between $42.24 and $26.53—a choppy zone that could stick around unless buyers show up with real conviction.

Still Bullish… Sort Of?

Now, let’s not hit the panic button just yet. Technically, the macro bullish structure isn’t broken—yet. As long as HYPE holds above that value area low on the daily close, this could still shape up as just a classic dip within a larger uptrend.

But if that floor gives way? Then we’re talking about something bigger. A deeper consolidation, maybe even the start of a broader trend shift.

The post HyperLiquid Slips Below Key Resistance — Is $30 the Next Stop? first appeared on BlockNews.

Read More

Cardano’s Tug-of-War: Whales Selling, Retail Holding, Shorts Circling

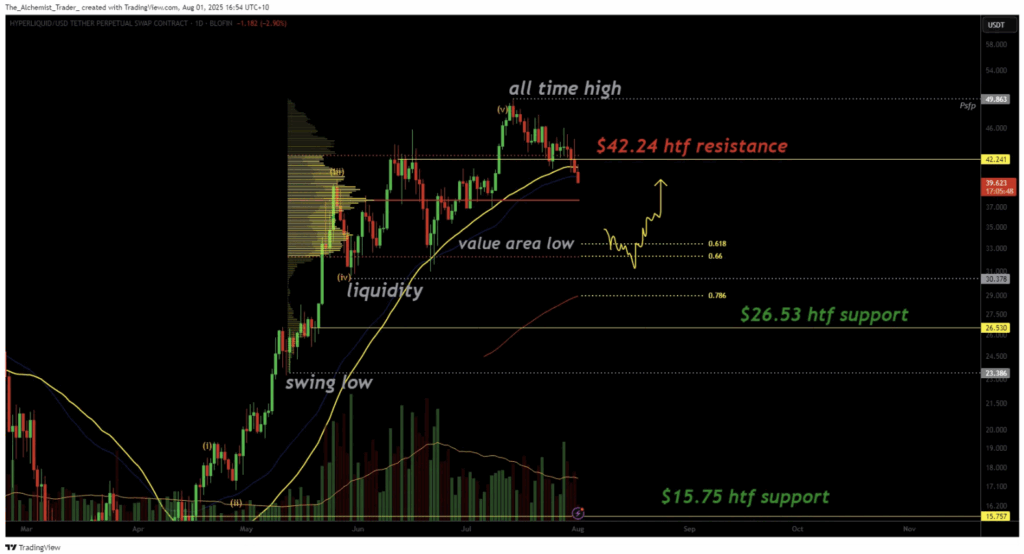

HyperLiquid Slips Below Key Resistance — Is $30 the Next Stop?

- HYPE lost the $42.24 level after a failed breakout, entering correction territory.

- Support levels to watch: Point of control (current test) and the $30 zone below.

- Volume’s fading, which increases the risk of deeper downside unless bulls step in soon.

Well… that breakout didn’t last long. HyperLiquid (HYPE) made a bold run above $42.24—setting fresh all-time highs—only to slip right back under it, losing grip on what many considered a major resistance-turned-support level. And now? The chart’s starting to look like a slow-motion retreat.

With volume drying up and price sliding, HYPE’s momentum is officially in correction mode. All eyes are on that lower support near $30. If this keeps up, we might be headed there sooner than expected.

Breakout Rejected, Correction Kicks In

After flirting with the top, HYPE fumbled the $42.24 breakout and rolled over. What should’ve been the base for a new rally turned into a fake-out—a textbook deviation that often signals more downside.

The price is now heading toward the point of control (POC), a pretty important area that hasn’t been stress-tested in this current pullback. If it doesn’t hold here, the value area low around $30 is the next likely stop. And yeah, that level’s still got a big ol’ batch of untapped liquidity.

Volume’s Drying Up — That’s Not Great

Since hitting that all-time high, trading volume has been fading. That’s… not exactly what you wanna see if you’re hoping for a recovery bounce. Without strong buy interest, every support level becomes a maybe rather than a must-hold.

If $30 doesn’t catch this fall, the next level to watch is down around $26.53. A drop that low would basically carve out a wider range between $42.24 and $26.53—a choppy zone that could stick around unless buyers show up with real conviction.

Still Bullish… Sort Of?

Now, let’s not hit the panic button just yet. Technically, the macro bullish structure isn’t broken—yet. As long as HYPE holds above that value area low on the daily close, this could still shape up as just a classic dip within a larger uptrend.

But if that floor gives way? Then we’re talking about something bigger. A deeper consolidation, maybe even the start of a broader trend shift.

The post HyperLiquid Slips Below Key Resistance — Is $30 the Next Stop? first appeared on BlockNews.

Read More