XRP Struggles Under Key Resistance as Traders Eye Breakout Potential

- XRP is consolidating below $3 amid fears of a deeper correction or a breakout toward $4.80.

- Analyst Casitrades sees $2.65–$2.75 as the correction bottom and $3.21 as the breakout trigger.

- Geopolitical uncertainties, including tariffs and market volatility, could impact XRP’s path forward.

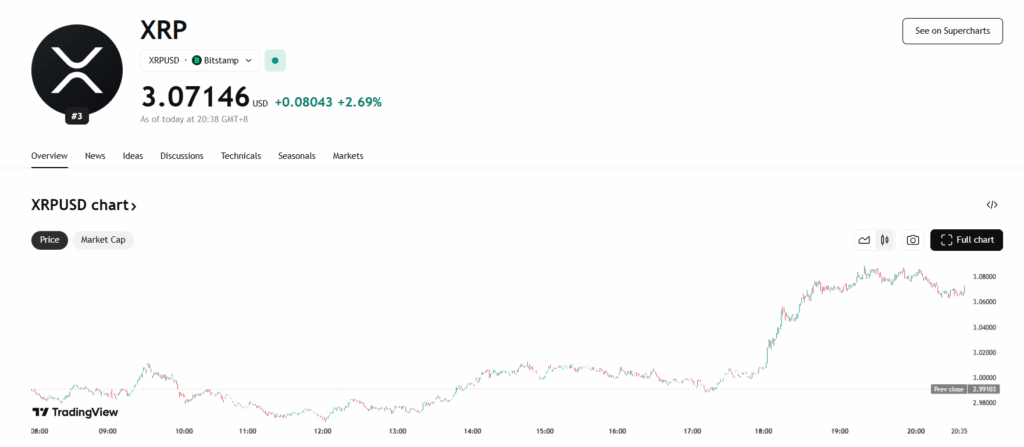

XRP is currently hovering between the $2.90–$3.00 range and trading sideways in August, stuck below a major resistance zone. After reaching an all-time high of $3.65, the altcoin saw notable profit-taking and sell-offs, creating downward pressure. Market uncertainties have amplified fears of a major correction, leaving XRP at a crossroads—it could either erase its yearly gains or surge to fresh highs, but its next direction remains unclear.

Analyst Predicts Correction Phase Bottom Before Potential Surge

Crypto analyst Casitrades recently shared a forecast on X, suggesting that XRP may bottom out between $2.65 and $2.75. According to his wave analysis, this zone represents the end of a corrective phase that began after XRP’s recent peak. Once this phase concludes, the token may rally toward $3.21. If XRP can reclaim that level and break through it convincingly, it could trigger a new bullish impulse.

The prediction outlines a possible climb to the $4.60–$4.80 range, with $4.00 acting as a psychological checkpoint. This would mark a historical milestone, as XRP has never breached the $4.00 mark before despite multiple attempts.

Key Support at $3.21 Could Trigger a Breakout

The $3.21 level is increasingly seen as the gatekeeper to higher prices. A confirmed breakout above it could signal that the corrective phase is over and a new bullish leg is beginning. If momentum builds, XRP could target the $4.00 milestone on its way toward $4.80. However, failure to hold above $2.65–$2.75 could signal more downside risk, especially in an uncertain macro environment shaped by tariffs and trade wars.

Caution Ahead Amid Geopolitical Headwinds

Despite the bullish outlook, analysts warn that external factors like U.S. tariffs and escalating trade tensions may suppress XRP’s price trajectory. Investors are advised to approach cautiously, conduct thorough research, and monitor key support and resistance levels. The $2.65–$3.21 range will be crucial in determining whether XRP can begin a sustained rally or if it’s in for further downside.

The post XRP Struggles Under Key Resistance as Traders Eye Breakout Potential first appeared on BlockNews.

XRP Struggles Under Key Resistance as Traders Eye Breakout Potential

- XRP is consolidating below $3 amid fears of a deeper correction or a breakout toward $4.80.

- Analyst Casitrades sees $2.65–$2.75 as the correction bottom and $3.21 as the breakout trigger.

- Geopolitical uncertainties, including tariffs and market volatility, could impact XRP’s path forward.

XRP is currently hovering between the $2.90–$3.00 range and trading sideways in August, stuck below a major resistance zone. After reaching an all-time high of $3.65, the altcoin saw notable profit-taking and sell-offs, creating downward pressure. Market uncertainties have amplified fears of a major correction, leaving XRP at a crossroads—it could either erase its yearly gains or surge to fresh highs, but its next direction remains unclear.

Analyst Predicts Correction Phase Bottom Before Potential Surge

Crypto analyst Casitrades recently shared a forecast on X, suggesting that XRP may bottom out between $2.65 and $2.75. According to his wave analysis, this zone represents the end of a corrective phase that began after XRP’s recent peak. Once this phase concludes, the token may rally toward $3.21. If XRP can reclaim that level and break through it convincingly, it could trigger a new bullish impulse.

The prediction outlines a possible climb to the $4.60–$4.80 range, with $4.00 acting as a psychological checkpoint. This would mark a historical milestone, as XRP has never breached the $4.00 mark before despite multiple attempts.

Key Support at $3.21 Could Trigger a Breakout

The $3.21 level is increasingly seen as the gatekeeper to higher prices. A confirmed breakout above it could signal that the corrective phase is over and a new bullish leg is beginning. If momentum builds, XRP could target the $4.00 milestone on its way toward $4.80. However, failure to hold above $2.65–$2.75 could signal more downside risk, especially in an uncertain macro environment shaped by tariffs and trade wars.

Caution Ahead Amid Geopolitical Headwinds

Despite the bullish outlook, analysts warn that external factors like U.S. tariffs and escalating trade tensions may suppress XRP’s price trajectory. Investors are advised to approach cautiously, conduct thorough research, and monitor key support and resistance levels. The $2.65–$3.21 range will be crucial in determining whether XRP can begin a sustained rally or if it’s in for further downside.

The post XRP Struggles Under Key Resistance as Traders Eye Breakout Potential first appeared on BlockNews.

After A New Correction Low: XRP’s Structure Still Has a Shot!

After A New Correction Low: XRP’s Structure Still Has a Shot!  (@CasiTrades)

(@CasiTrades)