Table of Contents

- Crypto Fundraising Reached Bull Market Levels

- The Share of Late Stage Round Increased

- Trending Sectors and Projects

- IPO Boom in Web3

- Conclusion

Table of Contents

- Crypto Fundraising Reached Bull Market Levels

- The Share of Late Stage Round Increased

- Trending Sectors and Projects

- IPO Boom in Web3

- Conclusion

State of Venture Capital in Crypto, Q2 2025

Crypto Fundraising Reached Bull Market Levels

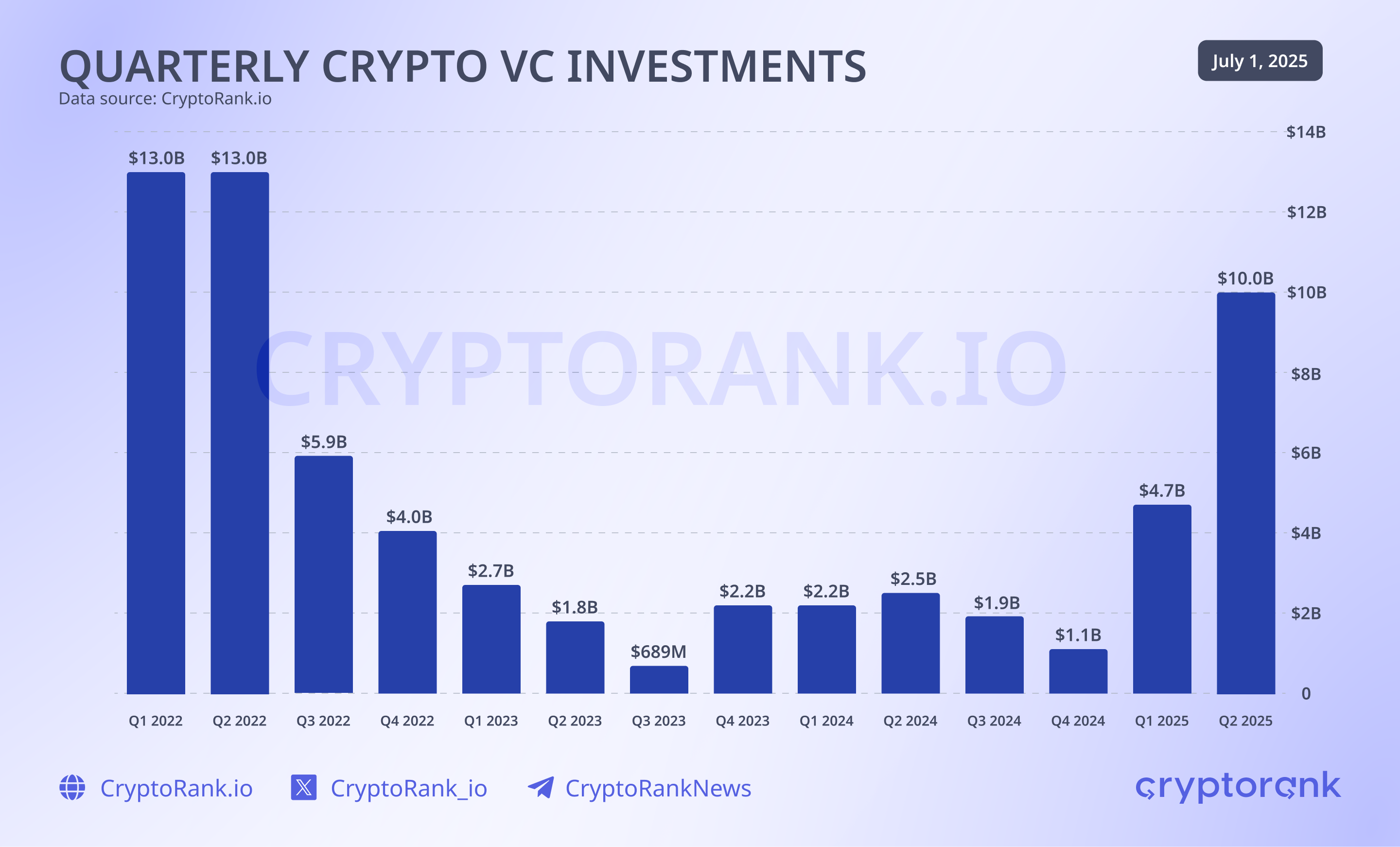

According to our crypto fundraising data, in the second quarter of 2025,, crypto fundraising experienced a significant surge, reaching levels not seen since the bull market of the previous cycle. It was the first time in three years when quarterly crypto VC investments were over $10 billion.

This sharp increase in quarterly fundraising activity only began at the start of 2025, following the arrival of the new White House administration and the introduction of a more crypto-friendly policy agenda.

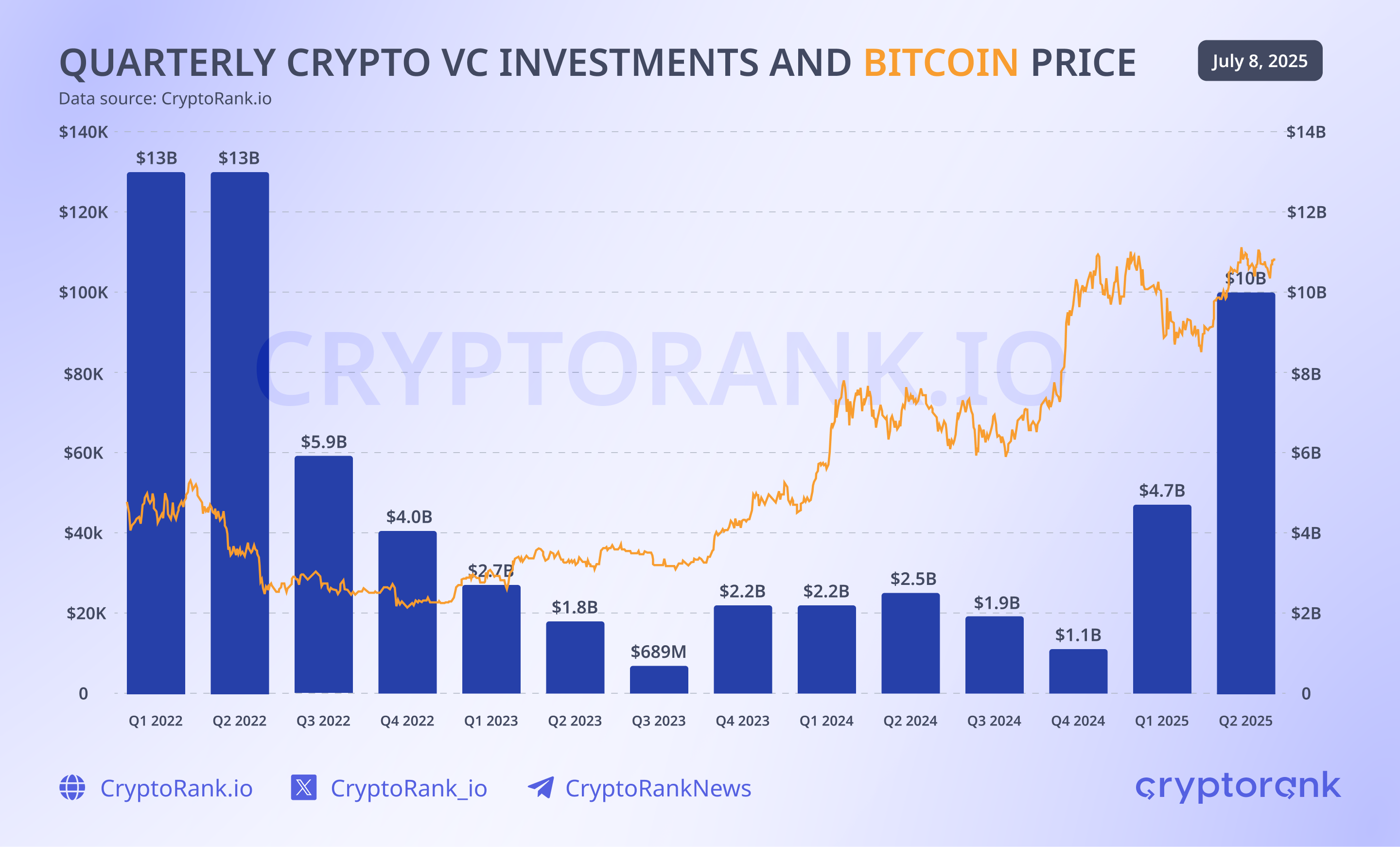

When comparing Bitcoin’s price rally to the growth of crypto fundraising, there’s a clear time gap between the two. This suggests that rising Bitcoin prices alone don’t drive venture investments in crypto. Instead, investors wait for clear and supportive regulations for Web3 projects. In fact, the real surge in venture funding only started after the White House signaled a more positive approach toward cryptocurrencies.

The Share of Late Stage Round Increased

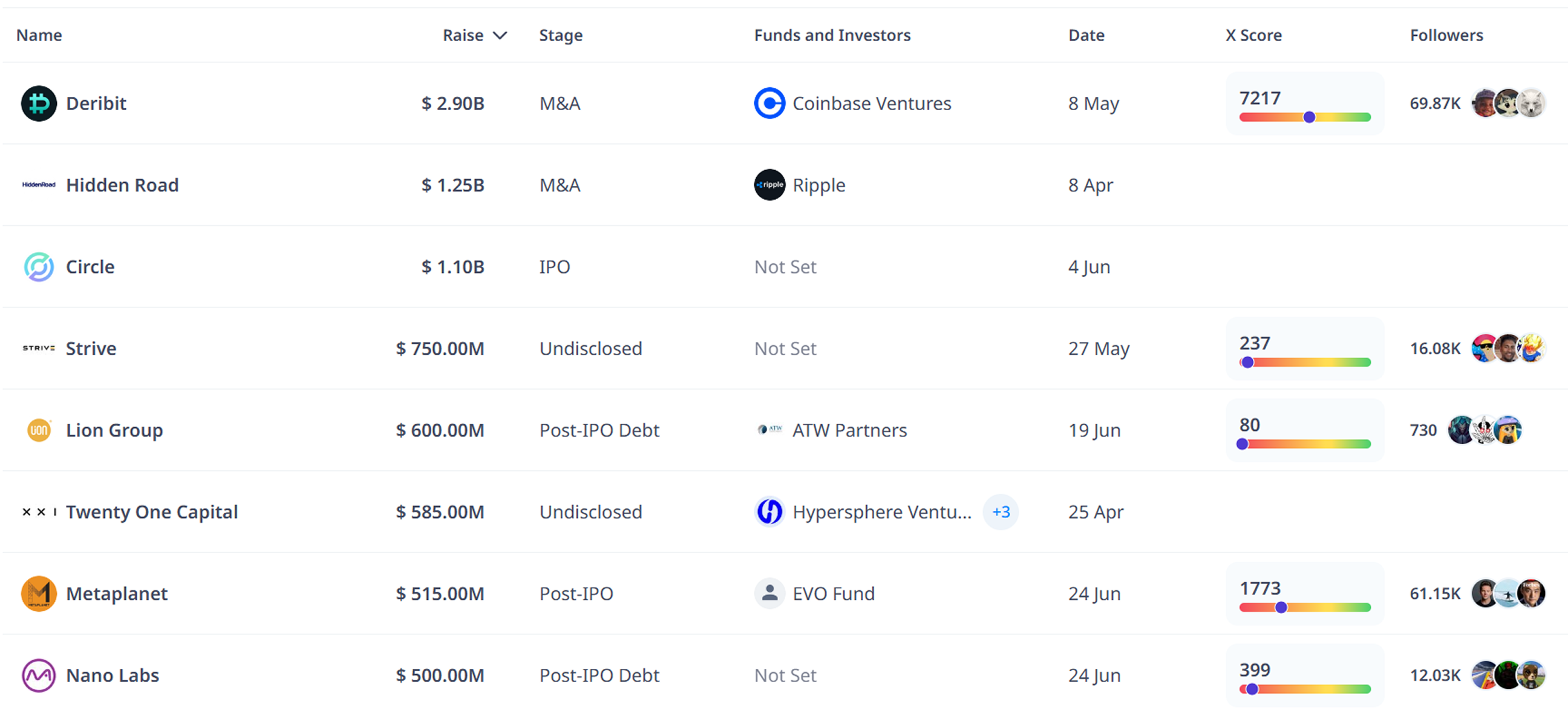

It is also worth noting that late-stage deals played a significant role in driving the growth of crypto fundraising in Q2 2025. These include IPOs, mergers and acquisitions, post-IPO debt, and other forms of late-stage financing.

Such transactions reflect a more mature phase of the crypto market, where high valuations are no longer based solely on future potential but are increasingly supported by revenues and other business metrics.

At this stage, the largest share of late-stage funding is at the intersection of Web2 and Web3. These include centralized exchanges, CeFi protocols, stablecoin issuers, investment funds, and mining companies.

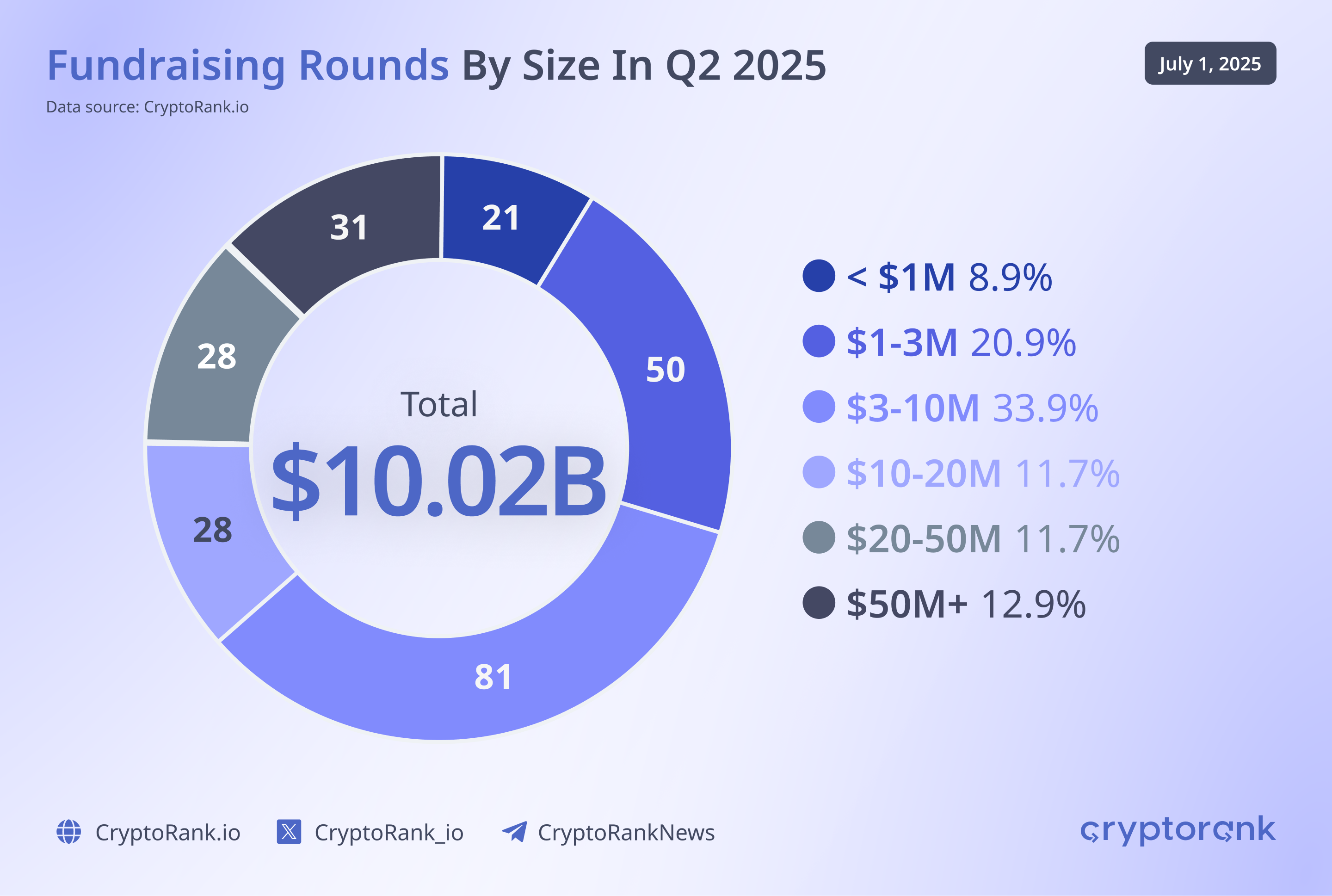

In total, there were 31 deals in the second quarter with funding rounds exceeding $50 million. At the same time, the smallest number of deals involved check sizes below $1 million, highlighting a rising entry threshold as the market becomes more mature and saturated.

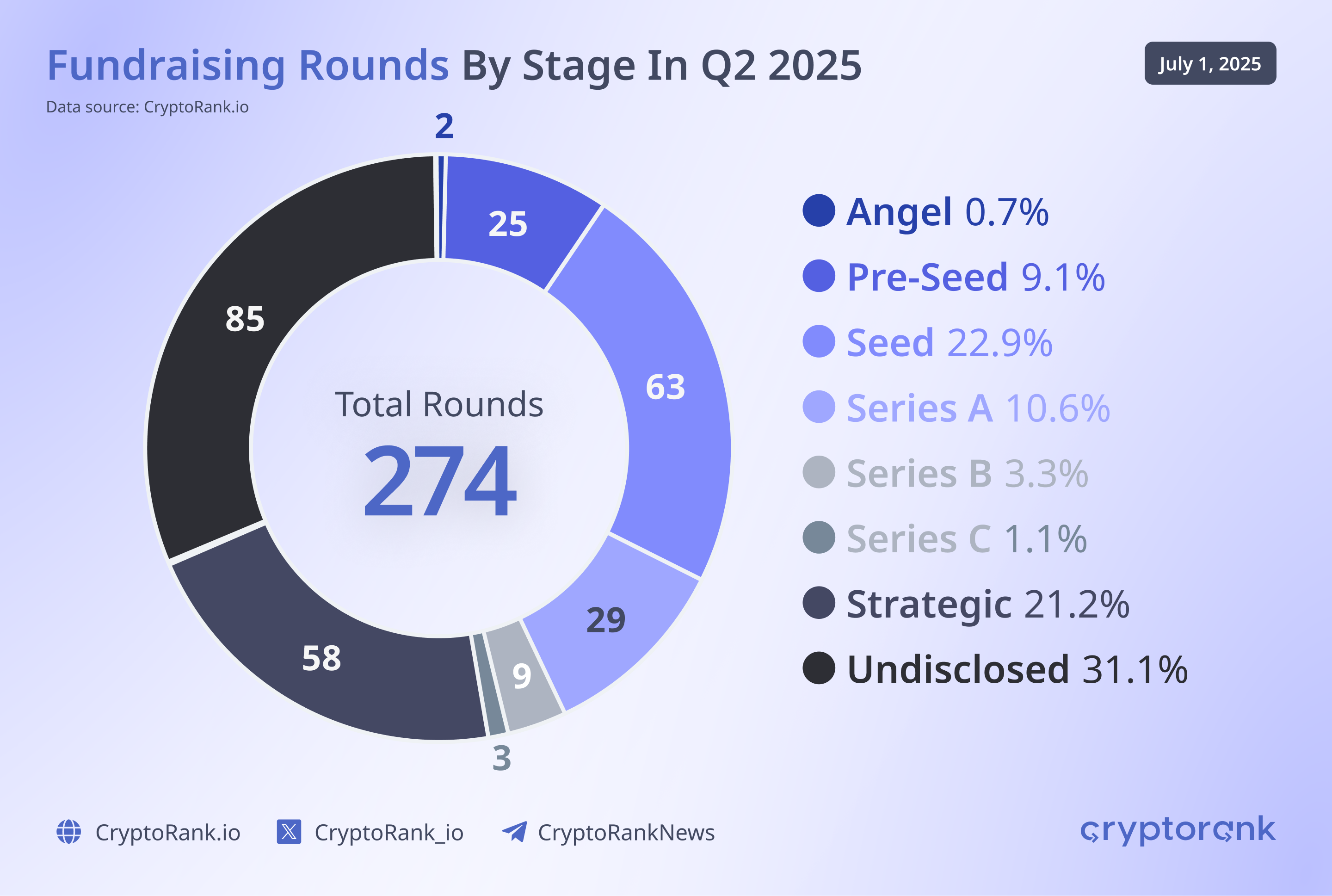

More than half of the deals are either undisclosed or classified as strategic, reflecting a shift in the dynamics of the crypto venture capital market. Projects are moving away from the traditional VC model of clearly defined pre-seed, seed, and Series A, B, C rounds with specific plans, timelines, and metrics. Instead, they are adopting a more flexible approach to fundraising.

This shift is driven by the rapid pace of change in the crypto market and the need for projects to pivot quickly. Those that fail to adapt to new market phases tend to disappear from the radar.

Trending Sectors and Projects

Currently, there is strong investment activity in sectors related to real-world assets, stablecoins, CeFi, and DeFi. These areas attract capital due to their clear and sustainable monetization models.

Blockchains also continue to see consistent demand from venture capital, though the focus has shifted. Instead of building general-purpose blockchains, projects in this category are now aiming to offer more specialized, niche solutions.

The AI sector remains a popular trend among venture funds as well. However, projects in this space are still actively searching for business models that can generate stable and lasting market demand.

Among the projects that caught our attention this quarter are Securitize, Kalshi, World Liberty Finance, and World. They caught our attention due to the size of the funding they raised, the quality of their backers, and their potential to influence the broader market.

Securitize raised $400 million from Mantle in this quarter alone, adding to previous investments from major players such as BlackRock, Circle, Blockchain Capital, Aptos, and others. Given this recent round, a near-term expansion of Securitize into the Mantle ecosystem seems likely. Today, Securitize is a market leader in the RWA segment, providing qualified investors with access to real-world assets and blockchain-based structured products.

Kalshi, a direct competitor to Polymarket, raised $185 million at a $2 billion valuation from investors including Paradigm, Sequoia Capital, and Multicoin Capital. Kalshi is expected to deepen its integration with the Web3 space and directly challenge Polymarket’s position. One of Kalshi’s key advantages is its substantial user base and regulatory licenses, giving it a competitive edge.

World, founded by Sam Altman, raised $135 million from Andreessen Horowitz (a16z) and other major investors. The project is currently expanding in the DeFi sector and rapidly growing its TVL. This private token sale round appears to be aimed at developing the World ecosystem further and strengthening its liquidity base.

World Liberty Financial raised a total of $125 million this quarter. The project has issued its own stablecoin, though its further plans remain unclear for now. However, the project’s association with the Trump family has significantly increased market interest.

If you want to discover more interesting projects that raised funding this quarter, use our platform, where you’ll find all verified deals in the crypto VC fundraising space.

IPO Boom in Web3

One of the key events of the quarter was Circle’s IPO. The company went public at $31 per share, and the stock is now trading around $233, delivering investors a return of over 5x so far.

More importantly, Circle's IPO marks a deeper integration of the crypto market with the traditional financial sector. It also sets a precedent, showing that when a crypto company has a sustainable, revenue-generating business model, it does not necessarily need to issue a speculative token without underlying cash flows, at least not at this stage of the market cycle. Instead, it can go the public route and offer shares backed by the actual performance of a Web3 service provider.

Conclusion

The fundraising market has entered a bullish phase, driven by a shifting regulatory landscape in the United States and a broader change in how crypto assets are positioned within the global financial system. At the same time, crypto fundraising has moved into a more mature stage, with a growing number of late-stage deals and valuations increasingly tied to real business metrics rather than speculative projections.

This trend is not just about Web3 projects integrating into traditional finance. It’s also moving in the opposite direction, as traditional financial institutions and funds are entering the Web3 space in search of higher returns or competitive advantages. New sectors like RWA and AI are developing rapidly, while established areas such as blockchains and DeFi are actively exploring new business models and use cases.

Looking ahead, the next quarter is expected to bring even more positive regulatory shifts. The potential signing of the GENIUS Act and other Web3-related initiatives could reinforce the trends set in the first half of the year.

Disclaimer: This post was independently created by the author(s) for general informational purposes and does not necessarily reflect the views of ChainRank Analytics OÜ. The author(s) may hold cryptocurrencies mentioned in this report. This post is not investment advice. Conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. The information here does not constitute an offer or solicitation to buy or sell any financial instrument or participate in any trading strategy. Past performance is no guarantee of future results. Without the prior written consent of CryptoRank, no part of this report may be copied, photocopied, reproduced or redistributed in any form or by any means.

Table of Contents

- Crypto Fundraising Reached Bull Market Levels

- The Share of Late Stage Round Increased

- Trending Sectors and Projects

- IPO Boom in Web3

- Conclusion

Table of Contents

- Crypto Fundraising Reached Bull Market Levels

- The Share of Late Stage Round Increased

- Trending Sectors and Projects

- IPO Boom in Web3

- Conclusion